Markets

Markets | Quarterly Markets Overview & Outlook

John Merrill, Tom Bruce, Curtis Holden, CFA®, April 3, 2025

SUMMARY. The financial markets of 2025 bear little resemblance to those of 2024. The biggest winners of last year –the "Magnificent Seven" and U.S. growth stocks – have been the biggest losers so far this year. In contrast, international developed stocks and U.S. value stocks have been the star performers, reflecting a significant rotation in market leadership.

One asset that has remained consistently strong is gold. It rose 27% in 2024 and added another 19% in the first quarter, recently breaking above $3,100 per ounce for the first time.

Table 1 shows the results for the major asset classes for the first quarter. All returns are total returns which include reinvested dividends, interest, and capital gains.

Source: Morningstar

CASH. Money market accounts continue to offer investors a healthy yield above 4%. How long yields stay at this level depends on when and if the Fed resumes its rate-cutting cycle. As of now, markets expect the Fed to begin cutting rates by mid-year, potentially at the June meeting. However, most observers, including the majority of Fed Governors, see money market rates staying above 3.75% through the balance of this year.

BONDS. Bond yields declined in the first quarter due to growing concerns about economic growth and ongoing signs of moderating inflation. This has provided a welcome tailwind to existing bondholders, as falling yields push bond prices higher.

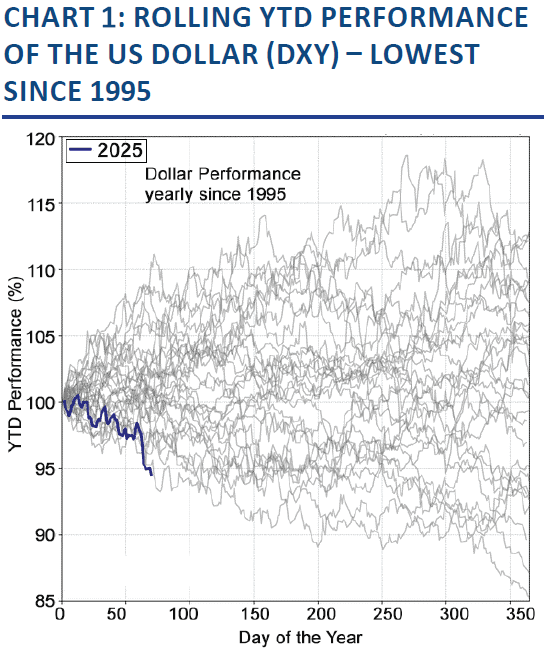

Yet, lower bond yields make our Treasury securities less attractive to foreign investors, resulting in reduced demand for the U.S. Dollar by extension. This has contributed to the U.S. Dollar (as measured relative to a basket of global currencies) being off to its worst start of the year since 1995. See Chart 1.

While lower yields make bonds less appealing, high-quality bonds still appear relatively attractive compared to equities if we are indeed in a slowing economy.

DOMESTIC STOCKS. Policy uncertainty has been the dominant theme of U.S. equity markets so far in 2025. Abrupt shifts in direction from Washington have unsettled investors and weighed on business planning, as discussed in the Economy section. This led to the first correction (down 10%+) of the stock market in almost two years.

Yet, under the surface of the stock market, much of the activity reflects changing preferences: high-growth stocks, particularly the Magnificent Seven that led in 2024, have seen sharp declines, while most other stocks have held up much better. See Chart 2.

Source: The Wall Street Journal

Source: The Wall Street Journal

Energy has been the top-performing sector year-to-date, up more than 9%, while Healthcare has risen approximately 6.1% as investors rotate toward more defensive areas of the market. These gains have helped stabilize broader indices; even as former market leaders have stumbled.

Through the quarter end, we did not see a major deterioration in corporate fundamentals. Revenues, margins, and profits have continued to improve, although analysts have revised earnings estimates slightly lower for the soon to be released first quarter numbers.

One challenge is Trump's perceived lack of support for the stock market. In a recently televised interview the president adopted a more detached stance toward the market than in his first term and declined to rule out a recession. He appears committed to his current course on trade, even if near-term disruptions persist.

While the Fed has limited flexibility to lower rates now, with inflation stuck above its target, Chairman Powell offered some reassurance in the March policy meeting that the Fed has the flexibility to act if any signs of economic weakness appear.

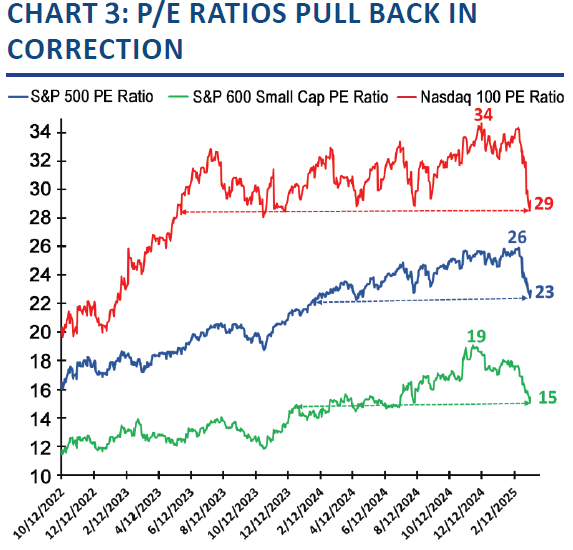

After the stock market’s 10% correction, valuations are now more attractive than they were at the end of 2024. Price to earnings ratios pulled back across the board. See Chart 3. Periodic corrections like the one we experienced are a normal and healthy feature of a long-term bull market. Historically, sustained bear markets tend to coincide with recessions. While a recession could still unfold, it would likely take a much larger deterioration within our economy.

There is not a lack of funds available to purchase stocks. Investor cash levels remain elevated – retail money market assets have doubled since 2022. See Chart 4. If recession fears ease, some of this capital will likely be redeployed into equities. Corporate buybacks, too, are expected to rise this year.

Source: Paulsen Perspectives

Source: The Wall Street Journal

INTERNATIONAL STOCKS. International equities have been a bright spot so far in 2025. Several factors have contributed to their strong performance:

Valuations: International markets, particularly in Europe and Asia, did not experience the same P/E multiple expansion seen in U.S. growth stocks during 2023 and 2024. As a result, they were more attractively valued, particularly as their earnings outlook improved.

Currency Tailwinds: The declining U.S. Dollar has boosted the value of foreign dividends and equity prices for U.S.-based investors.

Monetary and Fiscal Stimulus: Due to their slower growth abroad, many central banks abroad have lowered interest rates. In addition, recent fiscal stimulus efforts, such as Germany's $1.1 trillion infrastructure and defense package, have further improved the economic growth outlook. The combination of accommodative monetary policy and strengthening growth prospects is currently a powerful tailwind for equity markets.

Repatriation of Capital: The relative underperformance of U.S. stocks in early 2025 has prompted some foreign investors to reallocate toward their home markets.

REAL ASSETS. Real Estate Investment Trusts (REITs) and infrastructure benefited from falling interest rates during the first quarter. Both sectors generate income streams similar to bonds and tend to perform well when yields decline.

However, as rates have remained much higher than pre-2022, more stress could be ahead for those having to refinance loans that were made in the low interest period.

Infrastructure stocks are helped by support from global government spending on modernization as well as energy growth and transition.

GOLD. Gold has enjoyed an impressive start in 2025. Several factors are behind gold’s recent gains:

Tariff-Driven Demand: With the potential of tariffs on gold, U.S. banks moved to stockpile gold early in the year to have on hand to cover local “options settlements”. According to the Wall Street Journal, significant quantities were flown into New York from the United Kingdom in February, contributing meaningfully to the Q1 trade deficit.

Dollar Weakness: A declining dollar has historically been a tailwind for gold, and 2025 has been no exception.

Reserve Asset Appeal: Many central banks have continued to build their monetary reserves (See Chart 5) with gold. It is a reserve "currency" and store of value outside the reach of western sanctions.

While past gold rallies have been volatile, this one appears more broadly supported by currency trends, investor flows, and the steady buying of central banks.

Source: LSEG Datastream and © Yardeni Research, and IMF