Economy

Economy | Quarterly Economic Overview & Outlook

John Merrill, Tom Bruce, October 2, 2024

OVERVIEW.

The U.S. economy has shown persistent growth since the bottom of the pandemic shock. This is captured by the Conference Board Coincident Economic Indicators. See Chart 1.

Source: LSEG Datastream and Yardeni Research

Recent revisions to growth in the second quarter indicate that the economy was even stronger than first reported. GDP growth was revised up to 3.0% which is where the Atlanta Federal Reserve now estimates third quarter growth as well. This is strong overall economic growth.

Greg Ip, Capital Markets editor of the Wall Street Journal, summed it up nicely, “The U.S. now seems to have low inflation, low unemployment, and solid economic growth.” (9/20)

Gross Domestic Product (GDP) is the primary measure of the U.S. economy’s health. It is made up of four key components:

Government Spending

Consumer Spending

Business Investment

Net Exports

The first three are driving the economy forward.

Government Spending. Government spending—across local, state, and federal levels--is roughly 1/6th of GDP. At the federal level, there has been no indication of spending restraint and little at the state or local level either.

Though there may be future pressure to balance the budget, this does not appear to be a priority for either presidential candidate.

Consumer Spending. Consumer spending is the largest component of GDP, accounting for about two-thirds of total economic activity. Consumer spending has remained remarkably resilient, as shown in Chart 2, where spending picked right up where it left off after the pandemic reopening.

A large driver of the robust consumption trends have been the staggering amount of wealth created, primarily through real estate and stocks, since 2010. See Chart 3. This is the source of the wealth effect on spending of which we have written about in prior communications. Over $100 trillion of added wealth just since 2010.

Source: The Wall Street Journal, Deutsche Bank Research

Source: The Wall Street Journal

Older Americans, who have benefitted from homeownership and stock market gains, are driving much of the spending, but an unexpected contribution has come from Generation Z and Millennials. These younger consumers, often receiving room and board and other support from their parents, have the ability to spend in a manner that otherwise would not be possible.

The labor market has eased back from its post COVID snapback strength and normalized to where it was prior to the pandemic. Unemployment at 4.2%, remains low by historical standards. Employees are working more hours and wages are growing at a faster pace than before the pandemic, boosting total household income to record levels.

If the labor market was truly weakening, we would expect layoffs and a rise in applications for unemployment assistance. Instead, new unemployment claims have remained stable, and the number of people receiving unemployment assistance has begun to decline.

Business Investment. Business investment grew by a robust 4% over the 12 months ending June 30th. It was a torrid 8.3% rate in the second quarter. See Chart 4.

Source: The Wall Street Journal, Bloomberg

Large tech companies continue to invest billions into Artificial Intelligence (A.I.) development. This surge in spending has driven demand for Nvidia’s chips, the creation of new data centers, and new energy infrastructure.

Net Exports. The U.S. has run a trade deficit since the 1970s, meaning we import more than we export. This has a slight negative effect on GDP, but this could improve with the recent weakness in the U.S. Dollar as American goods become increasingly affordable for foreign buyers. This, in turn, may provide a boost to domestic manufacturing which has not participated in the otherwise strong economy.

U.S. OUTLOOK.

Economic growth will likely remain solid in the coming quarters as it picks up additional strength from lower interest rates.

On September 18th, the Federal Reserve (Fed) lowered the Federal Funds Rate (FFR) for the first time since it began raising interest rates in March 2022. With inflation seemingly under control (see below), the Fed has started to bring down interest rates accordingly.

Lower interest rates will help parts of our economy that have lagged –namely housing, small businesses, and households with higher debt loads.

At the same time, the wealth effect continues to grow as both the stock market and the housing market hit new highs to close out the third quarter.

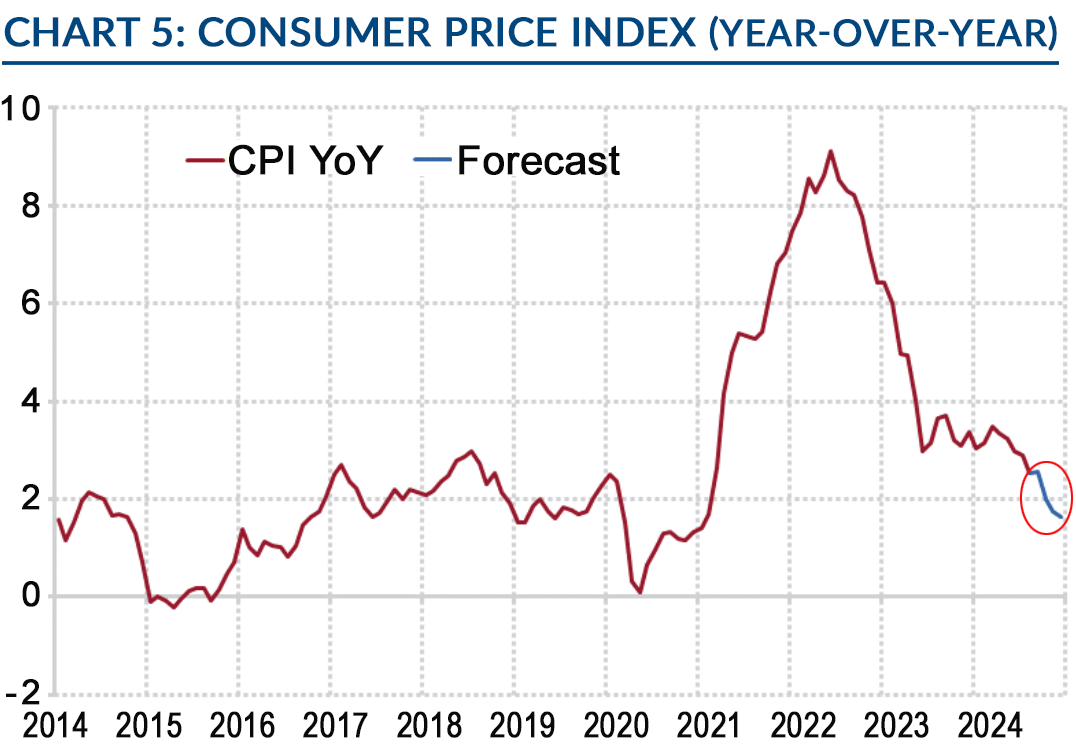

Inflationary pressures seem to be well contained at this juncture. The Fed projects inflation, as measured by the Personal Consumption Expenditures (PCE) index, to settle at 2.3% in 2024, 2.1% in 2025, and 2.0% thereafter. See Chart 5.

Source: San Francisco Fed's Research, Haver Analytics, BLS, Rosenberg Research

Global Outlook.

For the past two years, global growth has leaned heavily on U.S. growth as we have been the “island of prosperity” in an otherwise anemic growth world.

China, the world’s second biggest economy, has been suffering a severe housing downturn that is dragging down its economy. Homes in prices are down by between 15% and 30% across the country. Barclays estimates that the decline in Chinese real estate has wiped out a staggering $18 trillion in household wealth!

On top of this, the Chinese stock market was down almost 60% from its high in 2021 in late summer. For Chinese consumers the combination of losses caused a reverse wealth effect! Poorer consumers spend less which dragged down their economy.

This finally prompted the government to unleash a wave of monetary and fiscal stimulus toward the end of September to counteract the immense loss in household wealth. This “government bazooka”, as referred to by the press, may have wide-reaching effects, stimulating economic growth not only in China but also across much of the developing world.

Europe, the second largest economic region, has suffered a period of economic stagnation characterized by repeated periods of mild recession and chronically sluggish growth. This is largely due to structural economic challenges like over regulation and high taxes.

Mario Draghi, the former President of the European Central Bank, recently noted that "there is no EU company with a market capitalization over EUR 100 billion that has been founded in the last fifty years, while all six U.S. companies valued above EUR 1 trillion were created during this period." Furthermore, even when Europe does produce innovative tech companies, they often relocate to the U.S. to scale!

Europe must become more productive and more competitive if it is to compete with both the U.S. and China. As some have noted, it is becoming a nice museum reliant on tourism.

Emerging markets (EM) have finally begun to rise out of China’s shadow. The increasing acrimony between America and China has led companies to search out other locations for new investment. India, Mexico, Vietnam, and many others have been the beneficiaries. China’s recent stimulus may also ramp up EM trade with China.

Risks to Outlook. Though we are very optimistic on the economic outlook, we are always vigilant for potential areas that may be vulnerable. Three potential risks stand out.

Rising defaults. Delinquency rates for auto loans and credit cards have been steadily rising over the past year, mostly from lower income households. The risk is that this worsens and extends into middle class households as well. These households hold fewer investment assets and lower home ownership and therefore benefit less from the wealth effect.

Regional war. Tensions in the Middle East have risen dramatically, and the risk of a full-scale regional war is very high. This has worldwide ramifications as various parties may be drawn in. Economically, this has potentially meaningful consequences for oil, shipping, and trade.

Port Strike. The longshoreman's strike that began at midnight on September 30th has the potential to cripple our economy if not resolved quickly.