Economy

July 2024: Quarterly Economic Overview & Outlook

John Merrill, Brian Merrill, Tom Bruce, July 2024

REVIEW.

Our economy enjoyed robust annualized growth of over 4% in the second half of last year. It slowed considerably in the first quarter of this year to a 1.4% rate.

Growth rebounded sharply in the second quarter through mid-May only to fall off through June. For the full second quarter, the Atlanta Fed estimated at quarter end a 2.2% growth rate closely in line with the 2.1% average estimate of Blue Chip Economists. See Chart 1. It would have been 3% but for the unusually large deficit in exports.

Source: The WSJ Blue Chip Economic Indicators & Financial Forecasts

Growth in the 2% range is considered solid and sustainable for our economy.

The second quarter was again full of contrasts. The April Employment Report disappointed with an anemic figure, only to rebound strongly in May. In the same May report, the unemployment rate rose and we registered the most layoffs in nearly a year.

Another divergence developed between the Manufacturing and Services sectors. The Institute of Supply Management (ISM) reported that Manufacturing continued to contract in June, while the Service sector grew.

One reason our overall economy has performed as well as it has is that the highest earning consumers are responsible for the largest share of spending. The top quintile of income earners represent 39% of total spending. See Chart 2. This top quintile in particular enjoys the benefits of the "wealth effect" with household net worth at an all-time high. See Chart 3.

Source: The Wall Street Journal

Source: The Wall Street Journal

In addition, retirees are a rapidly growing consumer group that are more tied to changes in household net worth than to wages.

Yet the most significant anomaly is the ongoing health of our general economy for eight consecutive quarters despite the surge in inflation and the consequent steep rise in interest rates.

In past cycles, the large and lasting interest rate increases would have caused an economic slowdown…even a recession. The difference in this cycle so far appears to be the lack of interest rate sensitivity by both those that own homes (65% of households) and major corporations. These two groups have flipped the script of past cycles.

For most of the past 100 years, corporate America carried debt to equity averaging over 70%. Currently, the largest companies have little debt while the average within the S&P 500 is about 20%. In fact, many of the largest companies have more cash than debt and are therefore benefiting from higher rates!

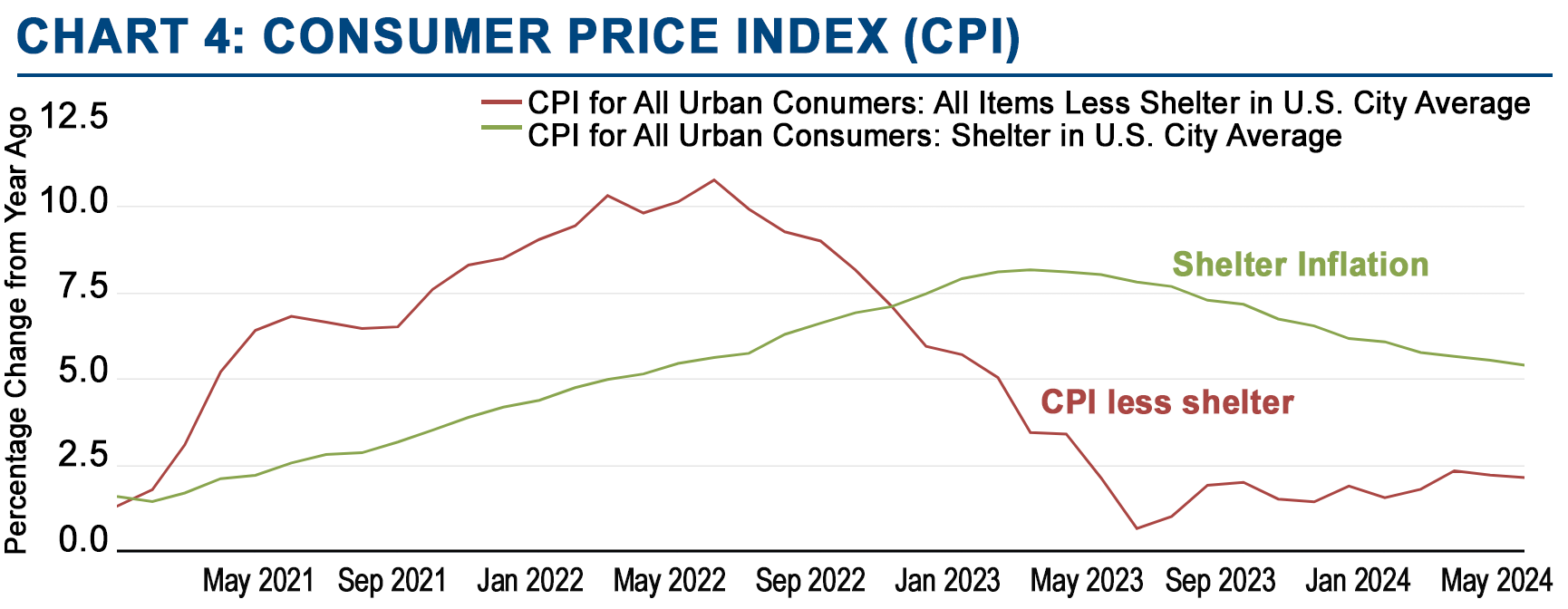

Most of the pandemic induced inflation is now gone. What remains is primarily the lingering impact of prior inflation on lower income and younger households as well as elevated shelter costs.

If shelter were excluded, monthly annual core CPI inflation would have ranged between 1.8% and 2.4% from July of last year through this past February. However, the full CPI inflation rates for that period ranged between 3.8% and 4.7%. Chart 4 shows CPI inflation as well as shelter alone through June reports.

Source: U.S. Bureau of Labor Statistics, FRED

It would appear that we now have a housing (shelter) problem more than an inflation problem.

As a whole, the global economy remained "Steady but Slow". This is the title of the International Monetary Fund's (IMF) latest semi-annual World Economic Outlook report (4/24). Interestingly, the U.S. is one of the few countries for which they increased their growth projections.

OUTLOOK.

Over the next 6-12 months, how the opposing forces within our economy evolve could lead toward two distinctly different paths, either a “soft landing” or potentially a “hard landing” (recession).

Soft Landing. A soft landing implies that our economy’s current strengths – increased wealth, strong jobs market, solid wage growth, and lower inflation (outside of shelter) continue to power the U.S. consumer. Inertia remains a powerful force within an economy.

In this case, the Fed will likely be slow to reduce rates until they are certain that overall inflation (including housing) will hit their long-term 2% target.

Ironically, this may continue pushing home prices higher which is the opposite of what higher rates are meant to do.

On the other hand, high interest rates will continue to slow the economy as they disproportionally impact low-income groups (non-savers, no home), commercial real estate (as loans come due), and small businesses which buy on credit.

Hard Landing. A hard landing could develop if today’s economic “cracks” become fissures.

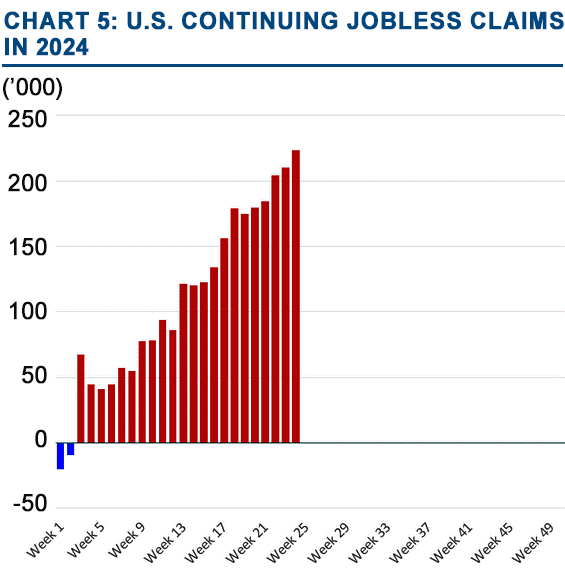

The biggest internal threat is that more of our middle class starts to experience economic strain from a sharp rise in unemployment and job insecurity. The rise in "Continuing Jobless Claims" this year may be an early warning. See Chart 5.

Source: The Wall Street Journal

Source: Bloomberg, Rosenberg Research

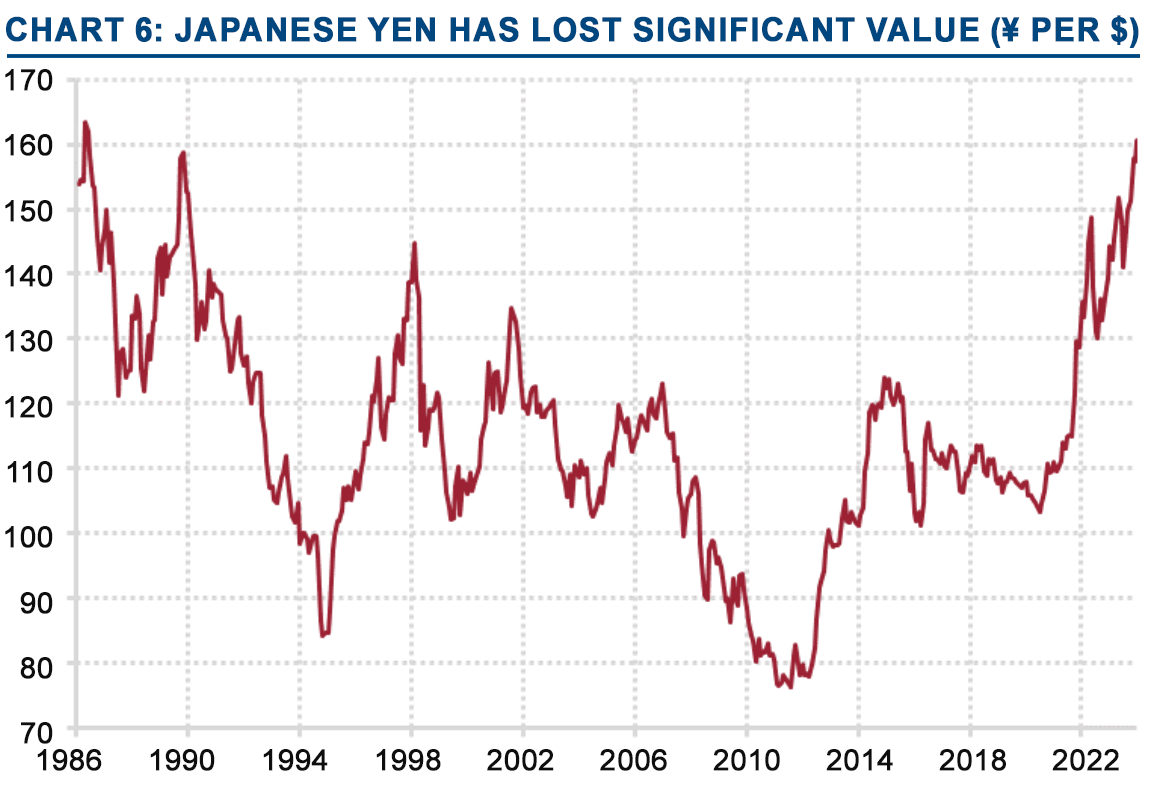

External threats to our economy have also increased, including an expanding war in the Middle East and/or Ukraine (driving the price of oil over $100/bbl), an unanticipated break in global supply chains (Taiwan’s semiconductors?), or a currency crisis (Japan is under extreme pressure as its currency has suffered a huge loss in value). See Chart 6.

Elsewhere abroad, there’s been a pronounced trend of electorates seeking change. There is a possibility of an extremist political party rising to power that disrupts the global economy.

In a hard landing, the Fed would likely cut rates significantly to support the economy as they did in the pandemic, Financial Crisis, and after 9/11.

Over the longer term, the outlook for the U.S. economy remains bright – even exceptional – compared to most other countries and regions.

In the post-Covid era, entrepreneurial fervor has surged, resulting in a record number of new businesses being created. We are only just beginning to witness the positive economic impacts of this trend. See Chart 7.

Source: The Wall Street Journal, U.S. Census Bureau

As discussed in previous Commentaries, robust growth in the US can be attributed to its strong leadership in innovation, a culture of entrepreneurship, world-class universities, availability of capital, and a relatively business-friendly regulatory environment. This favorable backdrop has fostered dominant centers of influence within America.

A prime example is the unique ecosystem in Silicon Valley, which cultivated unparalleled innovation and allowed tech giants like Apple, Alphabet (Google), Nvidia, and Meta (Facebook) to achieve their dominant global positions. The concentration of these leading companies creates a synergistic environment that is difficult for competitors worldwide to challenge.

Similar dominant global ecosystems can be found in New York for finance, Los Angeles for entertainment, and Texas for energy.

Due in part to paltry R&D spending and an environment less conducive for new business formation, the European Central Bank projects less than 1% growth in Europe this year with only slightly better prospects for next year.

In summary, there are both internal and external threats to our economy in the second half of this year. Yet the US remains uniquely positioned to maintain its status as an island of prosperity well into the future.