Economy

Economy | Quarterly Economic Overview & Outlook

John Merrill, Tom Bruce, January 3, 2025

OVERVIEW. The U.S. economy exceeded almost everyone’s expectations in 2024, delivering strong growth and setting the stage for further expansion in 2025.

Our "Goldilocks economy," reflects the rare balance achieved between solid growth, moderating inflation, and a resilient labor market. It stands out in a sluggish global economy.

U.S. GDP grew at a solid 2.6% rate through the third quarter. The Atlanta Federal Reserve (Fed) predicts that the final quarter will continue the 3.0% rate of the second and third quarters. Consumer spending drove this growth, led by higher income households. Manufacturing was an exception remaining in a mild recession.

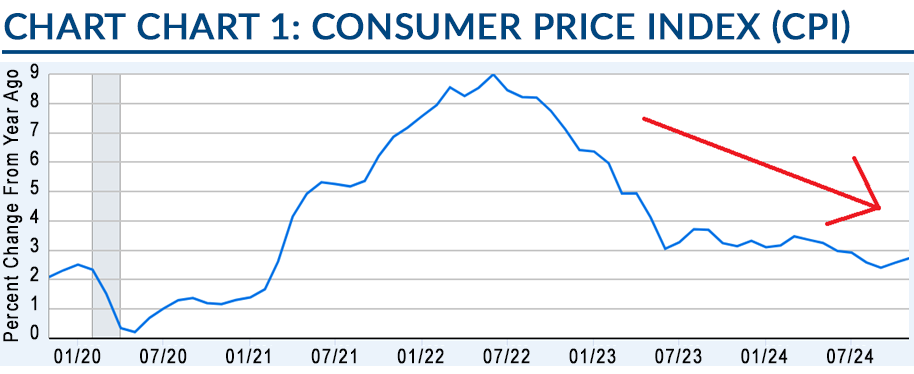

Headline inflation moderated steadily during the first nine months of 2024 and appeared to be closing in on the Fed’s goal of 2.0% in spite of a slight uptick in the final three months. See Chart 1.

Source: U.S. Bureau of Labor Statistics via FRED®

Low-income households have been hit harder by inflation than other groups. The Wall Street Journal recently reported that inflation has effectively averaged 6.3% on this group due to the disproportionate impact of rent, utilities, and food costs. This has impaired both their finances and consumption.

America’s labor market continued its strength in 2024. While the unemployment rate rose from 3.7% to 4.2% over the course of last year (See Chart 2), the rise was more attributable to large additions to the workforce than from increased layoffs.

Immigration, both legal and illegal, has been the largest source of our growing labor force. Without these laborers, many employers would not find the workers they need.

Even with a rising unemployment rate, labor shortages were seen in various segments of our economy. As a result, employers provided above average wage gains of 4% in 2024, which was one key reason inflation resisted a further decline.

The Fed has a dual mandate for setting interest rates (the Federal Funds Rate or FFR) – keep inflation low and the country at full employment. By September, with inflation falling and the unemployment rate rising, the Fed began to reduce its FFR from the very high rate set in 2022. It reduced the FFR three times from a top end of 5.5% to 4.5%.

However, the Fed was caught off guard by the year-end rise in inflation and a stronger than expected economy. It was forced to warn that the path ahead was uncertain, the message from the data was no longer clear.

Despite elevated interest rates throughout the year, business investment continued to be strong. Investment in technology was a key driver of growth in 2024. The artificial intelligence (AI) boom spurred enormous capital expenditures from computer chips, to data centers and renewable energy infrastructure.

Source: U.S. Bureau of Labor Statistics

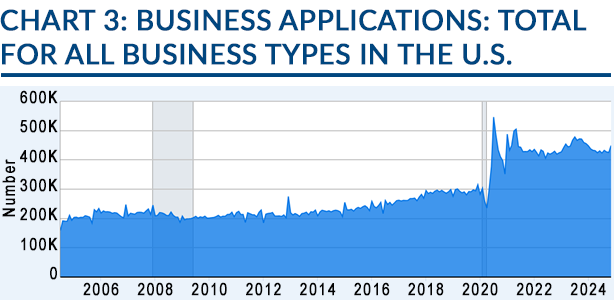

The dominance of our tech giants along with the ease of starting a business in the U.S. are driving factors behind what has been referred to as “American exceptionalism”. New business formations continued to surge in 2024. See Chart 3.

Source: U.S. Census Bureau via FRED®

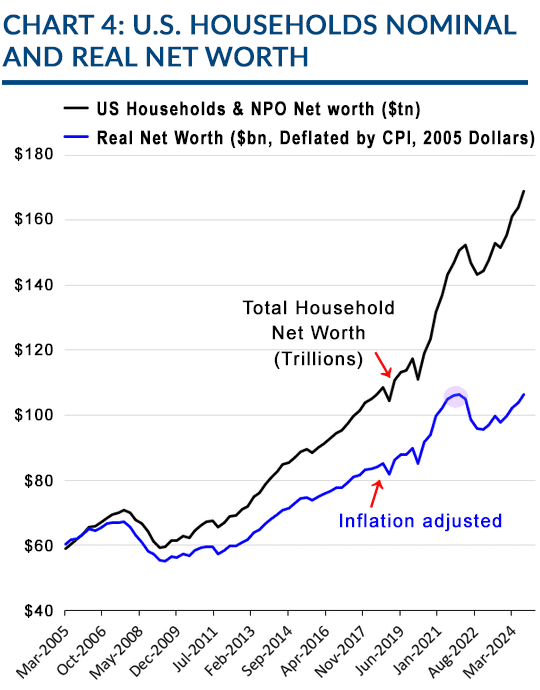

In addition, rising stock and real estate prices (as well as gold and Bitcoin) drove household net worth to a record high (see Chart 4) as the “wealth effect” fueled consumer confidence and supported discretionary spending by high net worth households.

Source: The Wall Street Journal

Those who do not own a home or have little or no investments did not enjoy the huge benefits from rising home and investment values. Many in this group are also among the low-income households that have been hit hardest by inflation. The steep rise in credit card loan defaults are mostly from these low income, low net worth households.

One other financially disadvantaged group has been young people just starting their careers. They have little to invest and find the dream of home ownership well beyond their financial ability – both because of much higher home prices and higher mortgage costs (See Chart 5).

Only those with family financial help – or high dual incomes – will likely be able to achieve the American dream until well into their 30s or 40s. This has had a dramatic impact on our economy as marriages, children, and home ownership have been pushed back.

Source: Freddie Mac via FRED®

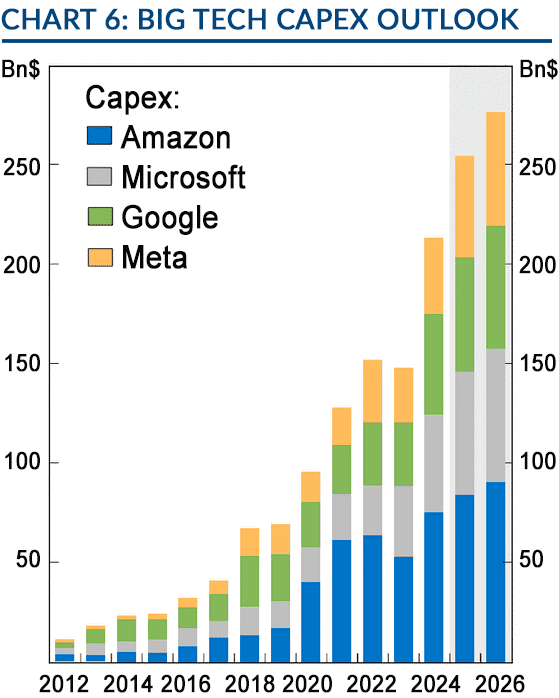

OUTLOOK. The U.S. economy enters 2025 with the same tailwinds that boosted the 2024 economy – robust business investment (Chart 6), a solid labor market, and strong consumer spending.

In addition, the incoming administration’s focus on deregulation, tax cuts, and limits on government spending has added additional optimism across the business landscape.

Ed Yardeni, one of the few observers who rightly forecasted our strong economy and the stock market’s bull run, has aptly described the post pandemic period as the Roaring Twenties.

Source: The WSJ, Bloomberg Finance L.P., © Alpine Macro 2024

Yardeni suggested in 2019 that this decade could be a time when transformative technological advancements increase productivity and usher in a new golden age of American prosperity.

He now believes that AI adoption is accelerating productivity by creating new efficiencies. It has already revolutionized industries by automating complex tasks that once required hours of work by highly paid professionals. Even Walmart attributed a large portion of their increased earnings to the efficiencies of AI.

Consumer spending, which accounts for more than two-thirds of our economy, is expected to remain a cornerstone of U.S. growth in 2025. It should continue to benefit from above average wage growth and the wealth effect from large gains in net worth over the past four years.

In addition, the new administration proposes quicker approvals for infrastructure investment, tariff induced reshoring, and lower taxes on American made goods.

Together, these factors have the potential to create a virtuous cycle where increased business investment fuels job creation, drives stock market gains (boosting wealth), and leads to even greater consumer spending. This is behind the renewed optimism from business.

Yet, many of these policies will undoubtedly not turn out as planned. Increased inflationary pressures are one potential area of disappointment in 2025. Potential tariffs may make goods more expensive, and deportations could lead to labor shortages, driving wages higher.

Potentially lower energy costs and productivity gains could offset some or all of these inflationary impacts.

Given the possibility of more persistent inflation, the Fed is currently forecasting only a modest reduction in the FFR in 2025. Housing and other interest rate sensitive sectors of the economy are thus likely to continue to face relatively high interest rates. (However, it pays to keep in mind that the Fed’s forecasts over the past four years have been notoriously inconsistent.)

Another key concern is the pressing need for the U.S. to address its unsustainable budget deficits. There is optimism that the new Department of Governmental Efficiency (DOGE) can reduce wasteful spending.

Globally, the economic landscape is much less bright. China continues to struggle to right its economy after their real estate market collapsed. Europe continues to deal with chronically anemic growth and a manufacturing recession. Emerging markets are challenged by the strong U.S. Dollar.

In summary, the U.S. economy is well-positioned to enjoy continued strong growth into 2025. Yet there are potential risks that could disturb this growth including the unknown impact of new tariffs, resurgent inflation, and further weakness in the global economy that spills onto our shores.