Economy

Economy | Quarterly Economic Overview & Outlook

John Merrill, Tom Bruce, April 3, 2025

OVERVIEW. The U.S. economy remains resilient as it enters the second quarter of 2025. While the economy has obviously slowed from the torrid pace of the past two years, labor market conditions remain solid, consumer spending is holding up, and inflation remains less than 1% away from the Federal Reserve’s (Fed) 2% target.

The Blue Chip Survey of Economists projects U.S. GDP growth of 1.7% in the first quarter, which matches the Fed’s growth estimate for the full year (2025). Both were weighed down by the heightened uncertainty coming out of Washington.

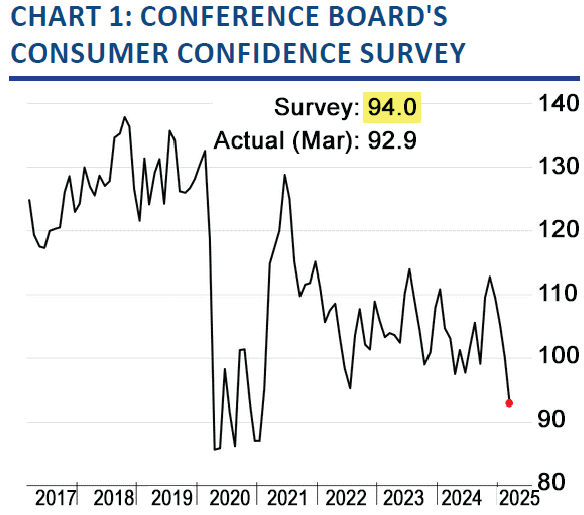

Reading the economic tea leaves has been more difficult than normal in the post-pandemic period. Conflicting signals have emerged between the so-called “hard data” and “soft data”. The hard data – such as employment, income, and spending – remains relatively strong. However, soft data, including surveys of consumer and business leaders, have weakened noticeably. For example, the most recent Consumer Confidence Survey shown in Chart 1 would normally indicate that consumers are scaling back their purchases.

Source: The Wall Street Journal, Conference Board

There has often been a disconnect between how people respond to surveys versus what they do… consumers may report pessimism (after seeing the news media?) while continuing to spend as normal. However, the magnitude and persistence of this divergence has significantly widened in recent years.

Part of the challenge is that the quality of survey data has deteriorated. Not only are far fewer people responding to surveys, but sentiment indicators are increasingly influenced by partisanship with responses often reflecting political views more than economic reality. As a result, soft data has become less reliable, making it harder for investors and economists to discern where the economy truly stands based on such surveys.

This erosion in data clarity comes at a time of exceptional economic uncertainty, with competing narratives shaping the outlook. While some indicators point to continued strength, others reflect growing anxiety – particularly around shifting government policies.

One of the most consequential developments is the renewed focus on global trade policies (tariffs). As widely cited in the media, President Trump is embarking upon a mission to restructure global trade policy. The administration has levied tariffs on several of our largest trading partners, and there’s an expectation of major and long-lasting tariffs to come.

The overarching goals from these tariffs include growing domestic manufacturing, fostering fiscal discipline, reducing reliance on foreign supply chains, and strengthening the U.S. position relative to China. If these goals were achieved, the ultimate outcome of this trade reset could be a more self-sufficient U.S. economy and a safer geopolitical landscape.

Yet, no matter what is actually achieved, it is likely to come with significant disruption and costs in the near term. New manufacturing plants are not permitted, built, and staffed in a day – particularly by companies whose capital has been impaired by the cost of shutting down other facilities abroad.

While reshoring does employ more American workers, the price of its goods are often higher than those produced offshore, causing inflation concerns. Our new Treasury Secretary, Scott Bessent, agrees with this but calculates tariffs will only cause a one-time adjustment…a price he and others in the administration believe is an acceptable cost of longer-term economic growth and security.

Many business leaders are standing still while they process the implications. The velocity of policy changes – from new tariffs to administrative directives – is unnerving which makes many CEOs hesitant to commit to long-term decisions. When sufficient spending decisions are on-hold it can result in lower economic growth, and possibly even lead to job losses and either stagflation or a recession.

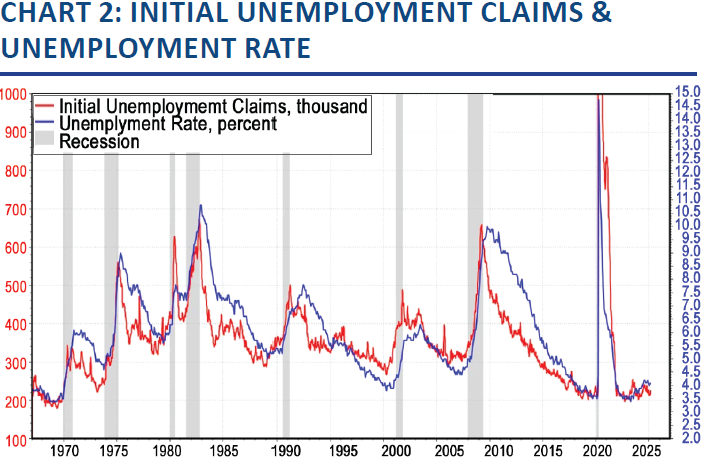

So far, however, the labor market has remained resilient. Applications for unemployment insurance and the unemployment rate have remained largely unchanged year-to-date and remain historically very low. See Chart 2.

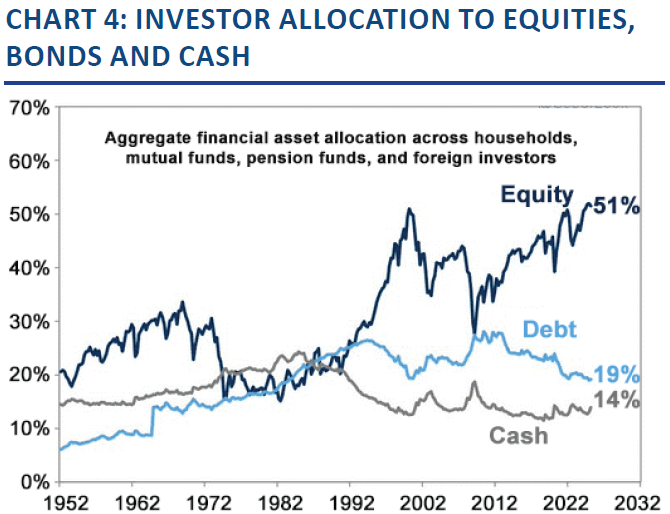

We have frequently written about the positive economic impact of the wealth effect – the behavioral impact of rising asset values spurring greater consumer spending, which in turn supports further asset growth. Over the past 25 years, this impact on economic growth has grown rapidly.

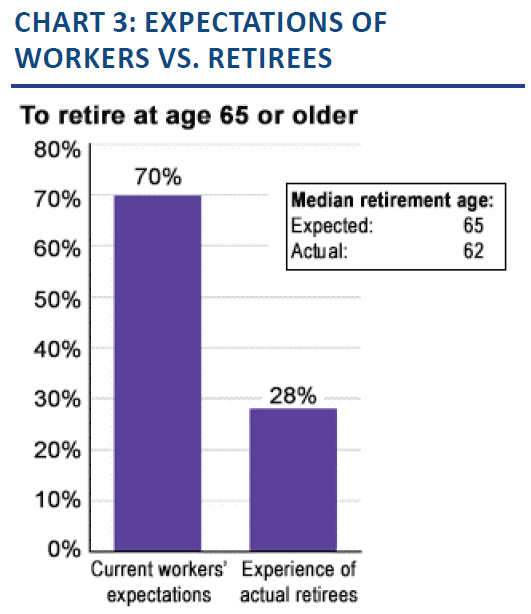

Many Americans have opted to retire earlier than expected, enabled by robust retirement accounts and significant home equity gains. Chart 3 shows that while 70% of individuals planned to retire at age 65, only 28% actually waited that long.

Source: LSEG Datastream and © Yardeni Research and Bureau of Labor Statistics

Source: The Wall Street Journal

This early retirement trend reduces labor force participation and makes the economy more reliant on asset values to fuel consumption. Though the jobs market is still the dominant driver of household income, today’s economy has become increasingly sensitive to equity market performance. This is particularly true with Investor allocations to stocks at an all-time highs. See Chart 4.

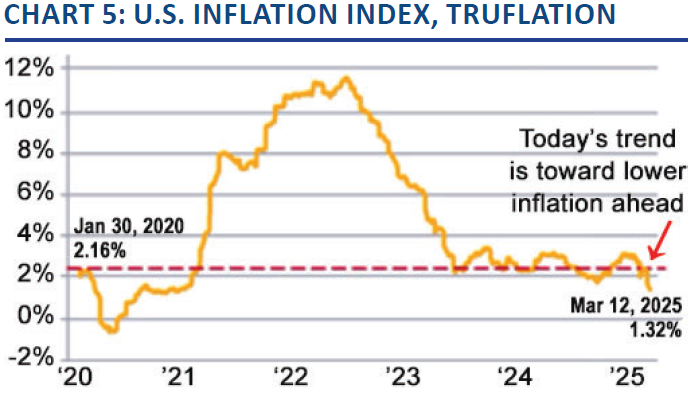

While tariffs may eventually have an inflationary impact (at least short-term) measures of daily changes in inflation such as those from Truflation suggest that price pressures are continuing to ease. See Chart 5. Should inflation follow this path, the Fed may resume rate cuts later this year.

Source: The Wall Street Journal, Goldman Sachs Global Investment Research

Source: Quill Intelligence, Mauldin Economics

This would have a positive impact on housing, commercial activity, consumer debt costs, and the federal government deficit through lower interest costs. This could at least partially offset some of the costs of the potentially disruptive activities discussed above.

Global Economy. European countries that once prioritized social benefits have begun to refocus on economic growth and national security. With the U.S. signaling a reduced willingness to serve as the guarantor of global peace, many allied nations are stepping up their own defense efforts. The resulting increase in military spending is expected to serve as a major fiscal stimulus, boosting economic activity across Europe, Japan, Australia, and South Korea.

Germany, for example, has long maintained a deeply ingrained culture of fiscal conservatism, shaped in part by the horrific inflation that followed World War I.

The German government recently approved a $1.1 trillion spending package aimed at strengthening defense and modernizing aging infrastructure. This could raise German GDP growth by over 1% per year for a decade. After a prolonged period of rolling recessions throughout the 2020s, Germany may now be positioned for a meaningful economic recovery.

OUTLOOK. The current outlook for the U.S. economy remains fundamentally strong. Our base case continues to favor a period of good growth, supported by resilient fundamentals and improved productivity from the rollout of artificial intelligence (AI).

Our economy is built around the consumer. The two primary sources of consumer spending are jobs and investments. Jobs not only produce the wages for most working age households, but they also pay the FICA taxes which support Social Security and Medicare. Investments support both retiree and wealthy households.

So long as jobs and wage growth remain healthy, and the markets remain resilient, our economy is on sound footing.

Yet, we are acutely aware that we have entered a risky period and much is at stake. If tariffs prove more inflationary than anticipated, the Fed may be forced to resume rate hikes – raising the risk of stagflation, a challenging mix of rising prices and slowing growth.

Economic growth could also come under increased pressure from delayed investments, hesitant consumer behavior, or escalating trade tensions that weaken economic momentum. These are the types of risks that could cause a more material economic slowdown which could lead to higher unemployment and lower financial markets.