Markets

Markets | September 2024 Market Update

John Merrill, Tom Bruce, September 2024

MARKETS.

Despite a volatile market environment, most asset classes enjoyed gains in August with REITs leading the way. The only exception was natural resources which posted a modest decline. See Table 1.

Domestic Stocks. From their low on August 5th, stocks rallied significantly, with the S&P 500 approaching a new all-time high. The market’s swift recovery underscored investor’s belief that there will not be a prolonged downturn in economic growth.

According to FactSet, 79% of companies beat earnings expectations in the second quarter. Earnings growth of 10.9% over the past year was the best performance since the pandemic recovery.

Expected rate cuts, combined with the robust second-quarter earnings season, contributed to a broader participation in the market rally.

Investors moved into areas of the market that had been lagging behind in the current bull market, including: value stocks, high dividend stocks, and small/mid-cap stock companies which are poised to benefit the most from monetary policy easing. Although we have seen rallies in these out-of-favor stocks earlier in this bull market, the arrival of lower interest rates could lead to greater sustainability of this momentum.

The resurgence of smaller companies has propelled the S&P 500 Equal Weighted Index (where each stock in the S&P 500 counts the same toward its performance) to new all-time highs. See Chart 1.

Source: Y-charts

Source: Haver Analytics, Rosenberg Research

The increasing number of stocks participating in the current rally is a constructive sign of a healthy stock market.

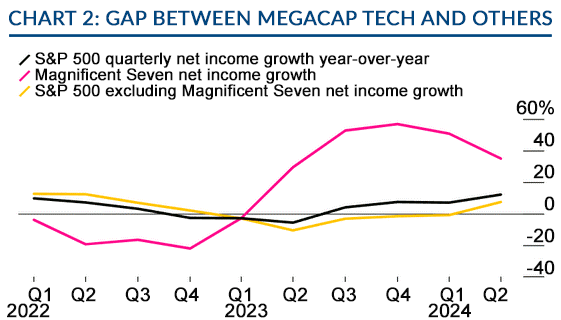

A key question now for the markets is the performance of the Magnificent 7 and other big tech companies in the months ahead. While earnings from major tech companies outperformed the broader S&P 500, the gap appears to be narrowing. See Chart 2. Investors have set a very high bar for tech earnings so the Magnificent 7 are unlikely to dominate the market like they did until August.

Source: The Wall Street Journal, Bloomberg Intelligence

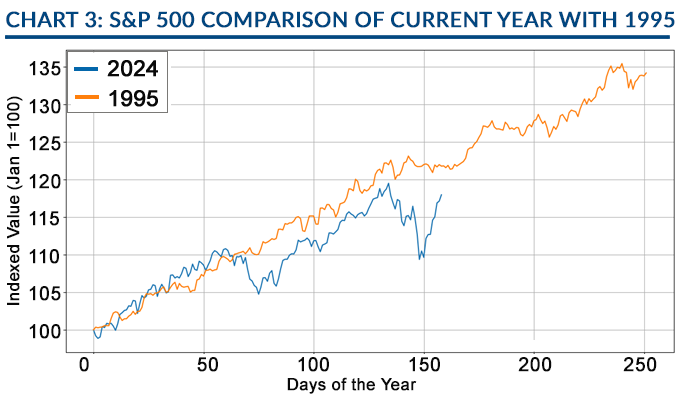

Yet large technology stocks utilizing AI could still power this bull market as the internet did from 1995-2000. Of all the years since 1928, the first 8 months of 1995 are the closest match with this year! See Chart 3.

Source: Tanglewood Total Wealth Management, Yahoo Finance

International Stocks. International stocks outperformed the S&P 500 for a second consecutive month. This comes as international stocks may also be coming back into favor as most central banks are easing interest rates.

One notable exception was the Bank of Japan unexpectedly raising its policy rate causing the yen to strengthen sharply. This sudden move led to a rapid unwinding of leveraged bets, resulting in Japan’s Nikkei stock index plunging over 12% that day, its worst drop since 1987. Highly speculative assets were hit even harder with Bitcoin ETFs tumbling 17%.

This “flash crash” episode highlights how highly leveraged areas of the financial markets are often connected, while broader unleveraged investments tend to be much less impacted.

Bonds. As discussed in the Economy section, a new easing cycle for monetary policy is expected to commence in September. The market anticipates that the Federal Funds Rate will drop from its current level of 5.50% to about 3.00% by the end of 2025. Consequently, money market and other short-term yields are set to decline in the near future.

The ten year Treasury bond yield has settled into a stable range between 3.75% and 4.25%. If T-Bills drop to around 3.00% as the Fed anticipates, the current yield of 3.91% on the 10-year Treasury is already a tight spread historically. Barring a recession, it’s unlikely that long-term yields will decline significantly.

Real Assets. Commercial real estate investors have been under pressure in 2024 with loans coming due. Many are in a precarious situation because obtaining new loans at current interest rates is not financially viable.

Thus, the coming reduction in interest rates gave REITs a boost in August. Natural resources, which do not benefit as much from lower interest rates, declined with the concerns over sluggish economic growth.

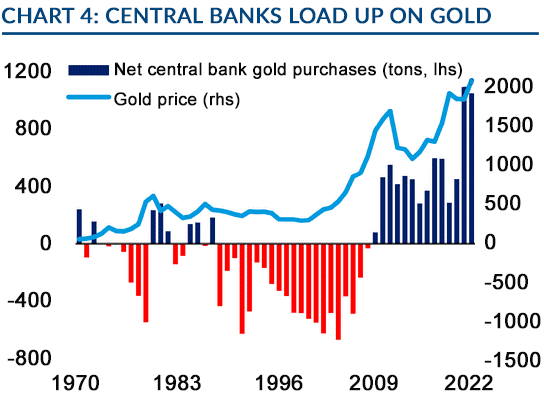

Gold. Gold has surged to new all-time highs driven by declining bond yields and rising geopolitical tensions. Central banks, especially the People’s Bank of China, have been purchasing gold aggressively. See Chart 4.

Source: The WSJ, BofA Glob. Res., Refinitiv GFMS, Metals Focus, Bloomberg, WGC

As we highlighted in our July Newsletter, central bank buying is expected to remain a significant driving force for gold. In addition, geopolitical issues continue to deteriorate.