Markets

Markets | Monthly Financial Markets Update

John Merrill, Tom Bruce, November 4, 2024

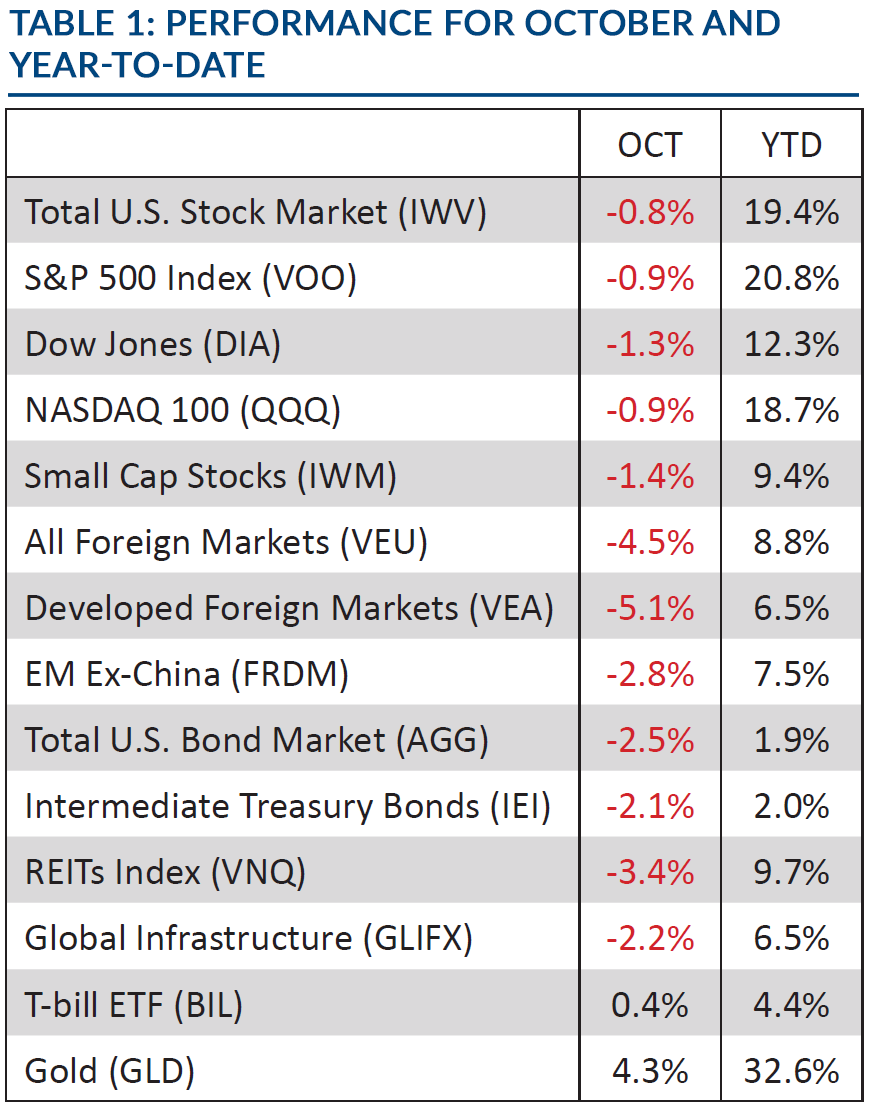

October was a month of heightened volatility due to the uncertainty surrounding the upcoming election and outlook for monetary policy. U.S. stocks declined modestly, bonds were under pressure, and REITs lost ground. Gold once again proved to be the biggest winner, adding to an already extraordinary year. See Table 1.

Source: Y-Charts

Domestic Stocks. Despite the month-end sell off, all three major U.S. stock indices reached record highs once again in October. Many of the themes discussed in the Economy section influenced the financial markets.

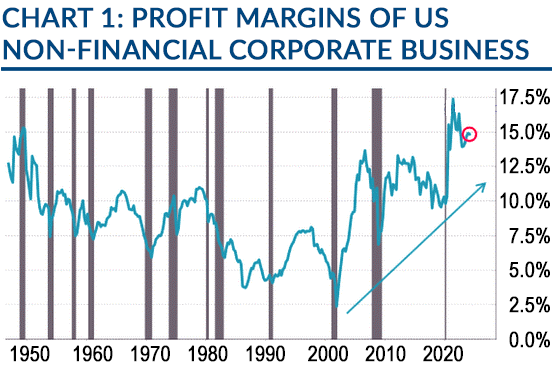

Strong Economy Produces Higher Profits: Stock prices follow corporate earnings (which have been steadily rising). Price/Earnings multiples tend to follow profit margins which have risen to a higher level post pandemic. See Chart 1.

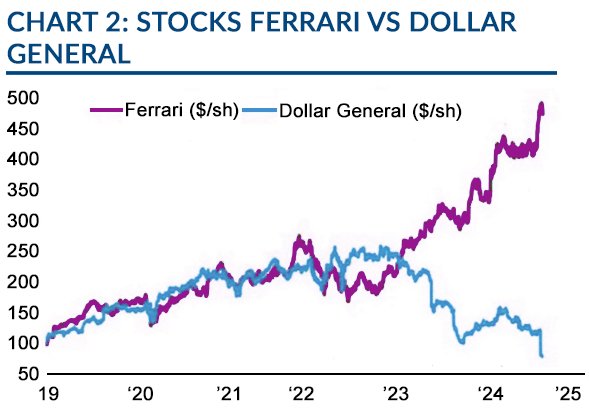

Uneven Performance: The different experience between income groups this economic cycle is reflected in the stock market. One interesting (if exaggerated) illustration is shown in Chart 2. It compares Dollar General’s stock performance (low income consumers) to that of Ferrari (high income buyers). This is yet another sign of the wealth affect.

Resumption of Tech Inflows: Renewed excitement about A.I.’s long-term potential buoyed tech stocks. After a challenging summer for tech, investor enthusiasm returned this fall, driving big tech companies like Nvidia to record levels.

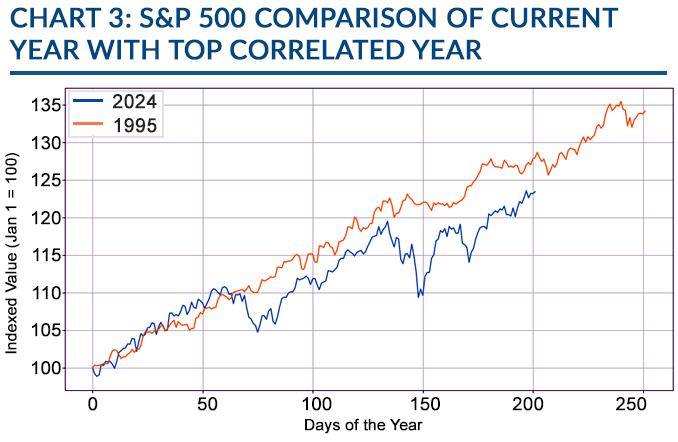

In our September Commentary, we introduced a chart comparing stock performance in 2024 to that of 1995, highlighting a striking 91% correlation between the two years. This correlation likely reflects parallels between both periods, including a tech boom and a “soft landing” engineered by the Fed. Since then, the correlation has grown stronger, adding another potential support for a year-end rally. See Chart 3.

International Stocks. Developed foreign stock markets declined in October, but not primarily due to poor individual stock performance. Instead, a more than 3% rise in the U.S. Dollar over the past month led to declines in international stocks when measured in dollar terms. When viewed in their local currencies many of the same international stock indices were up slightly in October.

China has been a primary focus for emerging markets investors. The Chinese government unveiled policy measures in September to boost their stock market. Initial results were spectacular with the Hang Sang Index gaining more than 30% in a matter of weeks. However, the initial enthusiasm has faded and their stocks have fallen back as government follow through has been limited.

Source: The Wall Street Journal, EPFR, Haver Analytics, Deutsche Bank Asset Allocation

Source: The Wall Street Journal, BofA Global Invest. Strategy, Bloomberg, Adam Taggart

Source: Yahoo Finance, Tanglewood Total Wealth Management

Bonds. Bond yields appear to be re-establishing their long-term relationship with inflation. Before the Financial Crisis (FC), the benchmark 10-year U.S. Treasury bond’s yield normally fluctuated between 4% and 5% except during the Dot Com recession. See Chart 4. This was close to its long-term average premium of 2% to 3% over the prevailing 2% inflation.

Source: The Wall Street Journal, Gavekal Research/Macrobond

During the FC, the Fed lowered the overnight Fed Funds Rate (FFR) to zero, an unprecedented move. The Fed maintained this “zero bound” policy for years after the FC. The yield on the 10-year Treasury bond followed the FFR down and traded in a new range of 1.5% to 3.5%.

At the onset of the pandemic, Fed Chairman Powell once again took the FFR to zero and this time the 10-year bond followed it down to as low as 0.5%.

The pandemic disrupted supply chains and brought on massive government programs. Together they caused a steep rise in inflation which the Fed reacted to with equally steeply rising interest rates.

The yield on the 10-year bond followed the FFR’s rise but has stayed mainly in the range of 3.5% to 5.0%, close to the pre-FC range.

As we stated in our September Commentary, we believe that the yield on the 10-year Treasury bond is likely to stay in the range of 3.5% to 4.5% (currently 4.3%) so long as inflation continues down to 2%. If instead, inflation proves resistant closer to 3%, then the range could be higher with the upper end above 5%.

Real Assets. REITs have also been volatile as investors gauge the future direction of interest rates. Real estate tends to perform better when rates decline, as this generally translates to lower loan costs. Despite the recent increase in bond yields, REITs have only seen modest losses—a resilience that may reflect investor comfort with current prices.

Gold. Gold was the biggest winner in October as it continued to hit new all-time highs. This was driven by a continuation of overgenerous government fiscal policies, central bank buying and geopolitical concerns.