Markets

Markets | Monthly Financial Markets Update

John Merrill, Tom Bruce, February 4, 2025

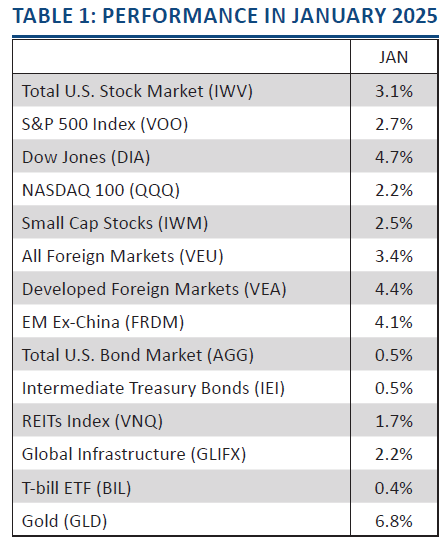

Most asset classes got off to a good start in January. Both U.S. and International equities (including emerging markets) posted strong monthly gains. REITs and infrastructure had more modest gains while bonds posted slight gains for the month. Gold once again led all major asset classes with its continued strong performance. See Table 1.

Source: Y-Charts

Domestic Stocks. The U.S. stock market entered 2025 with strong momentum, building on last year’s gains. The S&P 500 continued its climb and hit a new all-time high mid-month.

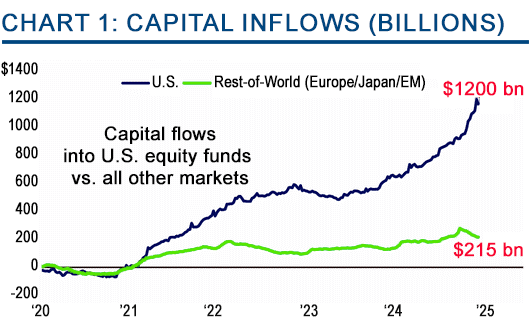

As pointed out in the Economy section, American companies uniquely enjoy access to a deep pool of capital. Since 2020, U.S. equity funds have accumulated almost six times the capital inflows of other developed markets. See Chart 1.

Another important source of our investment capital comes from corporate buybacks. They have been the largest source of market liquidity since 2000. Buybacks are projected to surpass $1 trillion in 2025, providing a steady stream of demand for stocks in the months ahead. See Chart 2.

Every bull market goes through a variety of shocks and setbacks. This one has at several points along the way, including the bank failures of March 2023.

January brought a sharp shake-up in the AI sector, raising questions about the sustainability of the tech sector leadership. The big shock came from DeepSeek, a Chinese AI company that unveiled a new model that appears to rival the best U.S. systems—apparently developed at a fraction of the cost using older-generation chips.

Source: The Wall Street Journal, BofA Global Investment Strategy

Source: LSEG Datastream and © Yardeni Research, and the Conference Board

The revelation sent shockwaves through the semiconductor industry, particularly Nvidia, which suffered its worst single day decline in nearly five years, losing $589 billion in market value. While all the claims must be substantiated, much of the tech industry as well as tech users may benefit if AI performance is achievable at significantly lower cost.

International Stocks. International markets started 2025 on solid footing, helped largely by a weaker U.S. dollar. As we have discussed in previous Commentaries, the strong Dollar has been a persistent headwind for international equities. When U.S.-based investors convert foreign earnings back into Dollars, currency strength erodes returns, pressuring international stock performance. In January the Dollar retreated from a multi-year high and provided a tailwind for global markets.

The benefits of a weaker Dollar are evident in both developed and emerging markets. Many countries hold significant debt and/or trade contracts denominated in U.S. dollars. When the Dollar strengthens, these obligations become more expensive in local currency terms, raising their costs. The opposite is true when the Dollar weakens, these costs all decrease.

Bonds. Bond yields and prices have gone up and down as bond traders scrutinize every inflation and labor market report in an attempt to predict what the Fed will do next.

There has also been a suspicion by some observers that the so-called “bond vigilantes” may have been behind the rise in longer-term rates since this past fall. Ed Yardeni coined this phrase back in the 1980s to indicate the concern bond holders had with rising government debt.

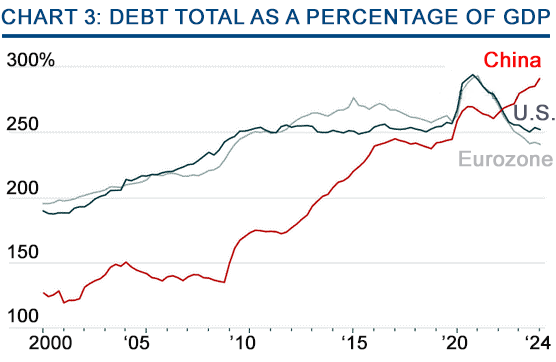

Yet, there is a major difference between then and now. In the ‘80s, the total debt load to be financed was rising rapidly (government, consumer, and corporate debt). This is far different today. The total debt load in our economy (that must be financed in the bond market) is roughly the same relative to our GDP as it was in 2010. See Chart 3. This is why the bond market has easily absorbed the increase in government debt. China’s debt problem (shown in red) is far worse and not improving.

Source: The Wall Street Journal, Bank of International Settlements

Real Assets. REITs have experienced significant volatility. The rise in bond yields since early this past fall has hurt their relative attraction. Yet, the strong economy is benefiting more areas of commercial real estate.

As noted in the Economy section, housing remains a key risk, with persistently high mortgage rates driving up costs for new buyers while locking in existing homeowners with much lower mortgage rates.

The demand for infrastructure has remained strong as reshoring continues to be a tailwind. However, should AI generation require fewer data centers and less energy, one of the more vibrant parts of both infrastructure and real estate could tail off.

Gold. Gold has continued to be a standout performer among major asset classes, benefiting from strong macroeconomic tailwinds including persistent central bank demand and geopolitical polarization.