Markets

Markets | Monthly Financial Markets Update

John Merrill, Tom Bruce, December 2, 2024

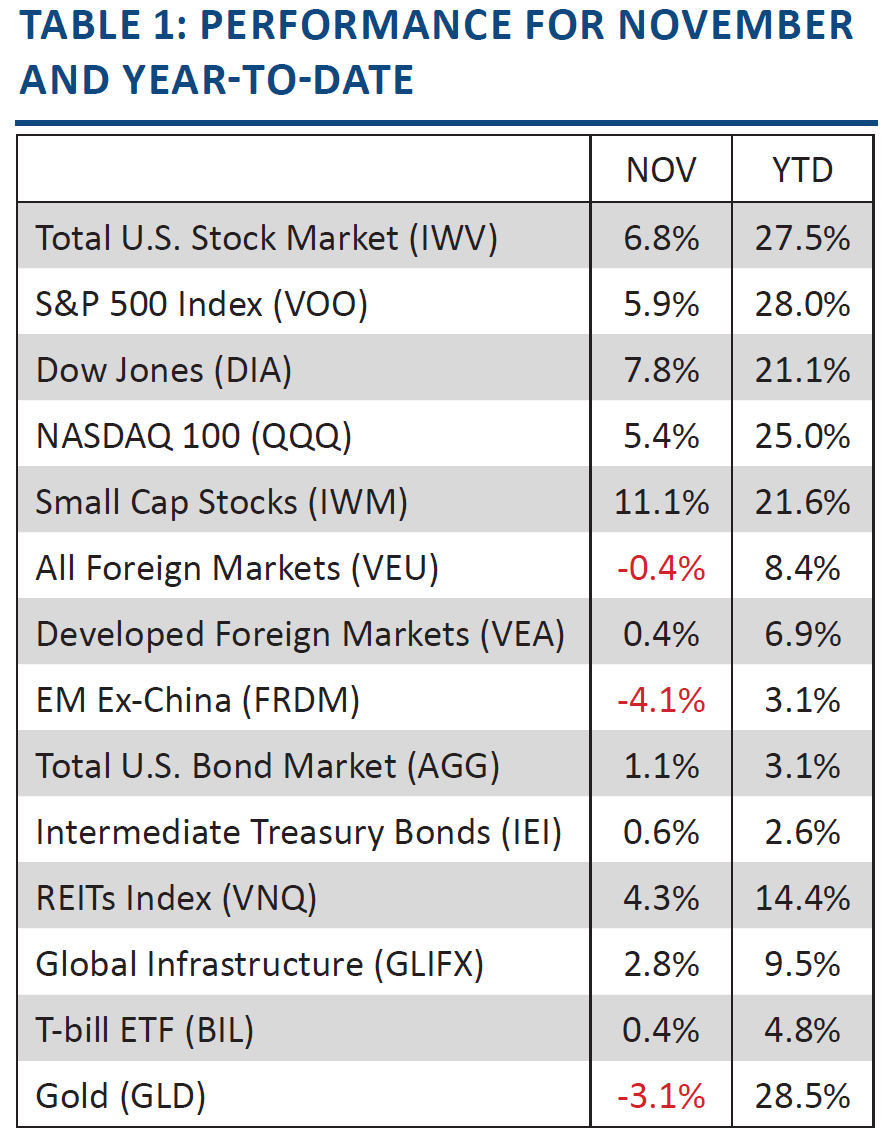

Strength in the U.S. economy along with the anticipation of upcoming policy changes in the new Trump administration were the primary drivers of financial markets in November. U.S. stocks had their best month this year, while interest rate-sensitive assets like bonds and REITs seesawed but ended positively. See Table 1.

Source: Y-Charts

Domestic Stocks. A wave of third-quarter earnings reports that exceeded expectations laid a strong foundation for market gains in November.

The rally gained further momentum after the election, as U.S. stocks surged on expectations of higher economic growth, reduced regulation, and lower taxes under Trump administration policies.

AI stocks had another month of strong performance driven by the impressive earnings reported by these companies. Yet the bull market continued to widen out to include other sectors as well as small and mid-cap stocks.

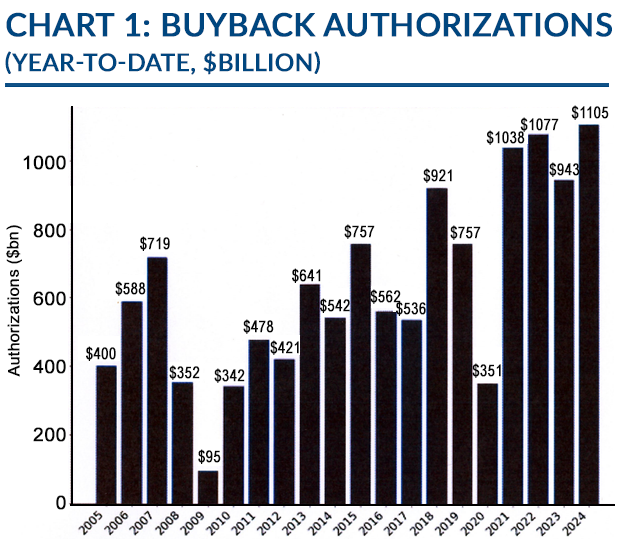

The U.S. stock market has benefitted greatly from the massive liquidity coming into the market. Individual Americans may set a record for net inflows this year ($450 billion so far), foreign investors have also ramped up their buying of U.S. stocks. (See International Stocks.) Yet the greatest source of market liquidity has been corporate buybacks. Over a trillion dollars will again be available from just this single source this year. See Chart 1.

Source: The Wall Street Journal

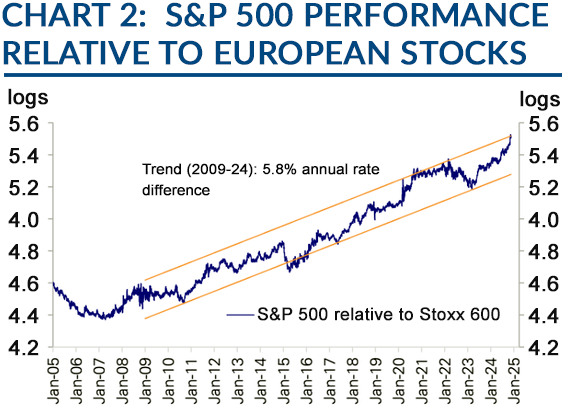

International Stocks. International stocks underperformed in November due to relative economic weakness, potential tariffs, and U.S. dollar strength.

For European stocks, this is a continuation of underperformance relative to the U.S. that dates to the Financial Crisis. See Chart 2.

Other factors hurting foreign stock performance include shrinking workforces, regulatory gridlock, and much less innovation (business investment and productivity growth) compared to the U.S.

As a result, there has been a significant shift in investor behavior. For example, Korean investors have increased their holdings of U.S. stocks from negligible amounts five years ago to over $100 billion today. See Chart 3.

Source: The Wall Street Journal, Deutsche Bank Research

Source: The Wall Street Journal, Korea Securities Depository, Bloomberg

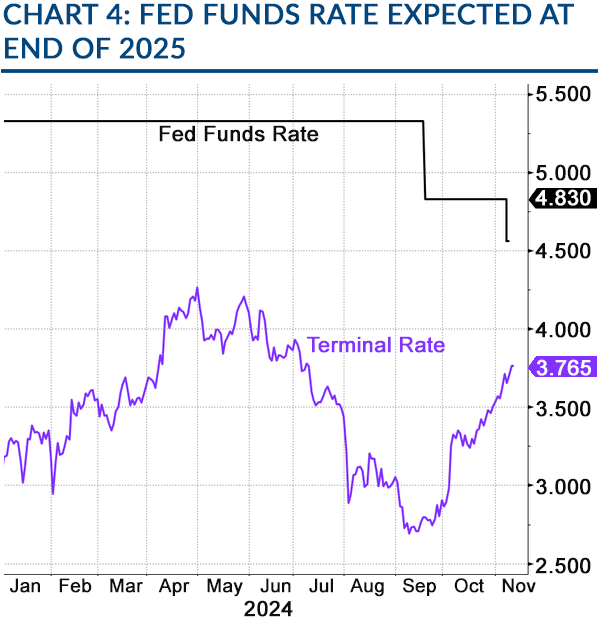

Bonds. Bond prices were very volatile in November. The already strong economy along with anticipated boosts from the incoming administration caused investors to temper their expectations for future Federal Reserve (Fed) rate cuts. This pushed up the markets expected “terminal rate” (where money market rates eventually bottom out) toward 4%. See Chart 4.

Source: The Wall Street Journal, Bloomberg Finance L.P.

The 10-year Treasury bond yield ended November with a yield of 4.19%. Historically, the 10-year Treasury yield would normally be at least 1.0% higher than the terminal rate which would put its expected yield closer to 5.0%. This suggests there could be pressure on bond yields to rise from current levels.

Real Assets. Real Estate Investment Trusts (REITs) rose in November with the strong economy and potentially beneficial Trump policies. However, a rise in bond yields would be a headwind for this asset class. Moreover, higher interest rates increase borrowing costs for real estate investors making it harder to refinance debt and potentially leading to financial strain.

Gold. Gold prices declined in November. Many investors now believe geopolitical tensions will decrease in the coming year with President Trump.

However, events later in November illustrated how hard bringing these wars to a just end will be and gold recovered much of its early decline.