Economy

Economy | Monthly Economy Update

John Merrill, Tom Bruce, February 4, 2025

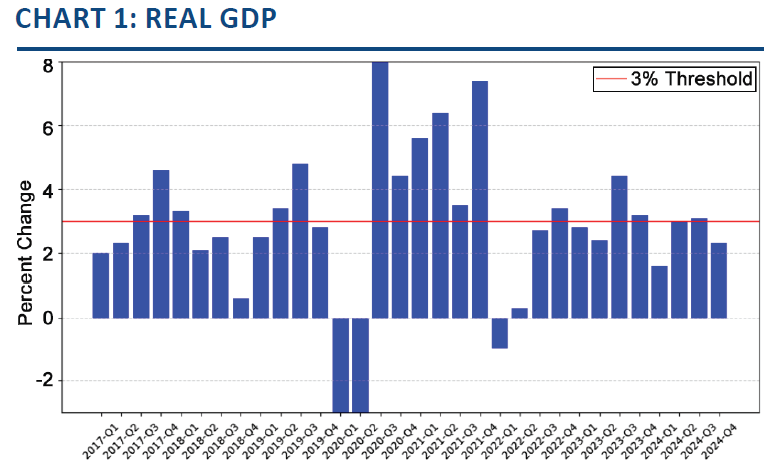

Our economy continues to generate strong economic growth averaging close to 3% real GDP over the past 10 quarters. This is well above the “potential long-term growth” that most economists thought the mature U.S. economy was capable of.

Our economy did end last year on a slightly weaker (but still solid) 2.3% growth rate. This despite a torrid 4.2% pace from consumer spending. See Chart 1. The major culprit for the fourth quarter slowdown was from changes in inventories which are notoriously volatile from quarter to quarter.

Source: Bureau of Economic Analysis

The three major components of GDP are the consumer, business investment, and government. As we have discussed in recent Commentaries, all three have contributed to the exceptional growth.

Consumers represent roughly 70% of our economy. Their strength has been supported by a solid labor market as well as the influence of strong gains in net worth (the wealth effect).

While we have discussed our labor market and the wealth effect extensively in recent Commentaries, it is worth noting that both have shown renewed strength as we enter 2025.

December saw a surprising surge in job creation with 256,000 jobs added (See Chart 2), bringing the unemployment rate down to 4.1%. This strong labor market coupled with rising job openings reinforces a strong foundation for economic growth.

Source: The Wall Street Journal, Bureau of Labor Statistics

The wealth effect got another boost to begin the year. Home prices continued to climb while the stock market set a new high in January.

A solid labor market combined with record household wealth has empowered consumers (particularly those in higher income households).

January’s annual meeting of business and political leaders in Davos, Switzerland was very different this year. Session after session, round table after round table centered around “American Exceptionalism”. They focused on the three areas of leadership that differentiate our economy from every other major country.

Capital Markets Leadership. Our capital markets dwarf those of the rest of the world. We have the deepest and broadest financial pools of liquidity. These markets have been built around the character of our entrepreneurs who think first in terms of opportunity, then risk. The potential for failure is acceptable if the opportunity is great enough. Much of the rest of the world sees failure far differently.

Energy Leadership. This is relatively new. For decades we were dependent on the outside world for both energy supply and pricing. Not anymore. Whereas we were formerly an importer, we are now a net exporter. As a result, the cost of supplying energy to both households and businesses is near the lowest among industrial nations. This is a huge advantage as this drives so many other economic factors.

Technology Leadership. American technology dominates the free world. This is a major reason behind our much higher productivity than other developed nations since the Financial Crisis. This is partly the result of the unique cooperation between our world class university systems with venture capitalists and entrepreneurs.

These are huge advantages that draw in not only the best and brightest of our own but also from around the world. If anything, all three have been supercharged – at least initially – by the anticipated policies of the incoming administration.

Economic Risks. While these areas of American leadership look secure, there are many risks that at least temporarily could derail our current level of growth.

Higher-for-Longer Interest Rates: While current inflation levels are significantly lower than their earlier peaks, progress has stalled. The latest CPI report indicates a year-over-year price increase of 2.9%, and inflation expectations have recently risen to 3.3% for the next year. See Chart 3.

Many economists now believe further rate cuts are unlikely at least in the next six to nine months. Mortgage rates have moved back above 7.0%. This has begun to weigh on housing activity, with price declines reported in cities such as Austin.

Geopolitical Events: Ongoing uncertainty surrounding global geopolitical tensions continues to pose a variety of risks. The Israel-Hamas ceasefire agreement helped to dial down tensions in the Middle East, but other conflicts have the potential to cause disruptions in supply chains. Furthermore, U.S. trade policy remains a major source of uncertainty with tariffs announced on February 1st against our three largest trading partners.

Source: University of Michigan, Investing.com

Source: Federal Reserve Y-14M Data, Federal Reserve Bank of Philadelphia

Labor Supply Constraints: Reductions in H-1B visas and deportations could strain our labor markets. This tightening of labor supply has the potential to hinder growth in key sectors and drive wage inflation higher, at least in the short term.

Uneven Economic Gains: Despite the strength of the broader economy, lower-income households are facing increasing financial stress. A recent report from the Philadelphia Fed underscores this trend, revealing a growing number of consumers who are only able to make minimum payments on their credit cards. See Chart 4. If fewer households increase their spending it could be hard to maintain strong consumer growth.

Each of these economic risks are well-known, yet each warrants careful monitoring as we assess the trajectory of U.S. growth in the coming months.