Economy

Economy | Monthly Economy Update

John Merrill, Tom Bruce, December 2, 2024

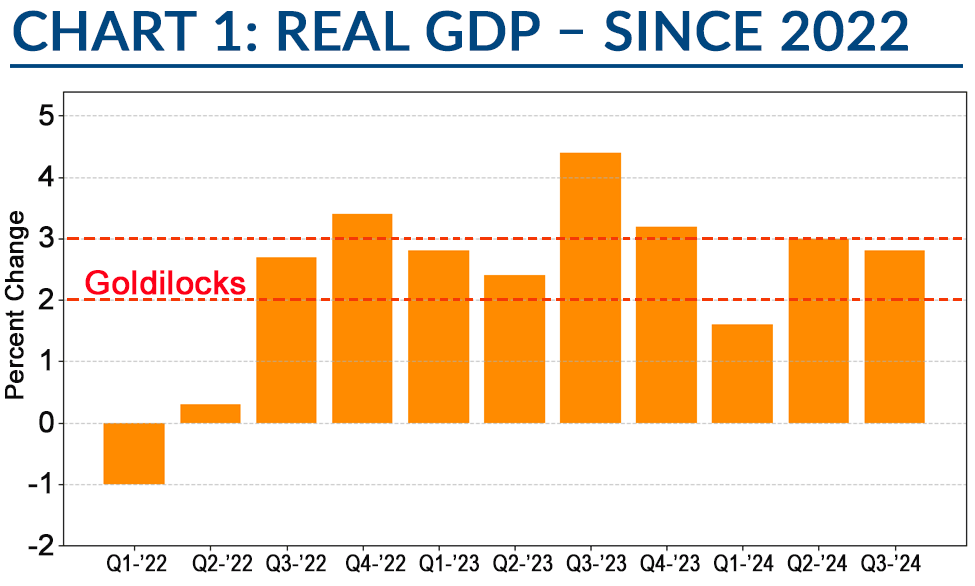

ECONOMY. U.S. economic growth was a solid 2.8% in the third quarter and is tracking 2.7% in the fourth quarter. Growth between 2% and 3% might be termed a “Goldilocks” economy – not too hot, and not too cold. Our economy is the envy of the world as it has been in this sweet spot for two and a half years. See Chart 1.

Source: U.S. Bureau of Economic Analysis via FRED®

Sustained growth above 3% could overheat our economy and lead to higher inflation. Growth much below 2% could slow down job growth, wage increases, and business investment while putting additional pressure on deficit spending.

Currently, business investment continues to surge as companies invest heavily into Artificial Intelligence (AI) capacity and uses. This was clear in the recent earnings reports from companies like Microsoft, Alphabet, Amazon, and Meta (Facebook).

Government spending was jump-started during the pandemic and has continued for many of the Biden administration’s new initiatives.

Consumers continue to benefit from a solid jobs market, above average wage gains (nominal and real), and a significant increase in personal wealth.

The U.S. jobs market is coming into balance. Average monthly jobs growth has slowed in 2024 with newly created jobs close to meeting – but not exceeding – new job entrants. The post-covid snapback in excess job creation appears to be mostly behind us.

A more balanced jobs market allows wage gains to settle into a more sustainable long-term level of growth. This supports consumption while putting less pressure on inflation. A healthy jobs market with rising wages is important across all household income levels.

Yet the prior surge in inflation has many lower income households still trying to catch up. This group is spending a higher percentage of its income on basic needs.

On the other hand, higher income households are increasing discretionary consumption. Much of this difference can be attributed to the “wealth effect” that we have discussed in recent Commentaries. Higher income households are much more likely to be homeowners and have meaningful investment accounts (including 401(k)s, IRAs, and pensions). The substantial increase in the value of both homes and investment accounts in the past four years has given these consumers the resources and confidence to spend.

The global economy is not faring nearly as well. Europe has been flirting with recession; Japan is fighting extreme currency weakness; China is in the middle of a “reverse wealth effect” as their consumers suffer both real estate and stock market weakness; and emerging markets in general have been negatively impacted by Dollar strength and China’s weakness.

Other “secret sauces” of the U.S. economy’s enviable performance have been the rise in productivity and energy self-sufficiency. Noted economist Ed Yardeni has pointed out the vast difference in productivity in the U.S. versus most other developed countries. With our leadership in advanced technology, he believes this will continue well into the 2030s.

In addition, the U.S. is the largest energy producer in the world and our electricity costs are the lowest – by far – among major nations. While our cost of electricity has fallen since before the pandemic (green bar in Chart 2) European nations have been met with huge increases over the same period (red bars).

Source: The Wall Street Journal, UK DESNZ/IEA

New Administration. Republicans had a clean sweep in the recent election. With complete control for the next two years (after January 20th), they are in a position to see a lot of their policy goals put into place. However, the margins in both the House and Senate are so small that compromises among Republicans will be necessary.

Incoming President Trump has hit the ground running. His picks for his new cabinet mostly reflect his personal goals for deportations of illegal immigrants, restrictions on new border crossings, relatively quick settlement of the wars in Ukraine and Israel, cutting excessive red tape, tax cuts, reducing the federal workforce and extensive use of tariffs.

All of these have potential consequences for our economy both in the short term and the long term. Deportations could be very disruptive to businesses that depend on these workers…for which we have few replacements. However, a balanced approach similar to what was passed in the House earlier this year may have long-term positive effects.

Trump has also proposed tax cuts to reduce corporate and individual tax burdens. Lower corporate taxes could encourage businesses to invest, hire, and innovate. Meanwhile, individuals may benefit from higher take-home pay, potentially boosting consumer spending. If enacted, these cuts may lead to increased economic growth, but also additional deficit spending.

Perhaps the most intriguing initiative of the incoming administration is the setup of the new Department of Government Efficiency (DOGE) led by Elon Musk and Vivek Ramaswamy.

Virtually everyone – both inside and outside of government – agree that the U.S. government is bloated with waste, fraud and abuse. Many have tried to address these issues before, let’s hope DOGE has more success.

Well targeted tariffs in both Trump’s first term and in Biden’s presidency have been viewed as successful by both parties. The massive across the board tariffs that Trump is now threatening would produce retaliations and broad changes in trade patterns. Some of this could be very positive for American reshoring and the American worker. However, it could also cause severe business bottlenecks and restart inflation. Many feel that such broad tariffs are less likely to be implemented than to be a starting point for new negotiations.

The ultimate impact on both the U.S. economy and global economy will depend on what is actually implemented and over what time period.