Economy

Economy | Monthly Economy Update

John Merrill, Brian Merrill, Tom Bruce, August 2024

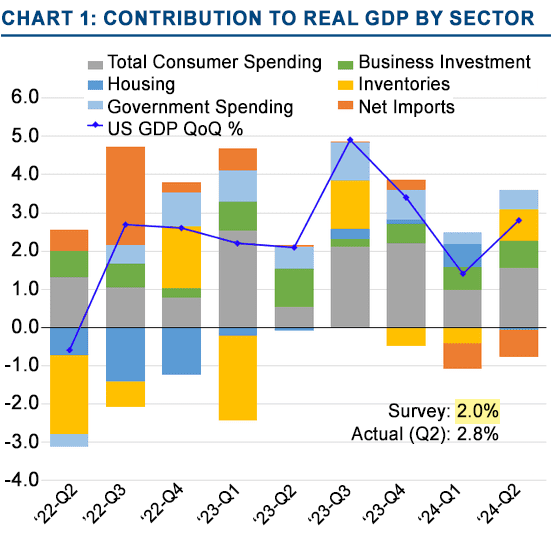

The advance estimate of U.S. Real GDP showed the economy grew by a robust 2.8% in the second quarter. Consumer spending, the most significant economic driver, showed renewed strength with an increase of 2.3%. Chart 1 shows both the total GDP (blue line) and the individual components for the past nine quarters.

Source: The Wall Street Journal

While this confirms the overall strength of our economy during the first half, it does not capture the growing underlying economic divergences.

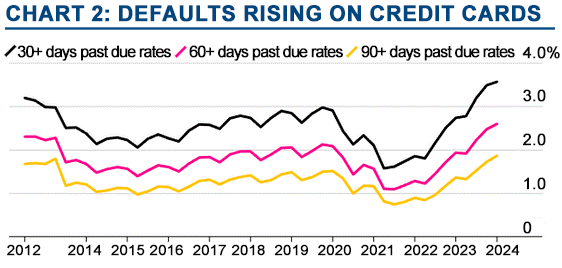

For example, the financial struggles of many Americans are reflected in rising credit card delinquency rates. See Chart 2. For many companies, lower income households (those most under stress) are an important segment of their customer base. Many companies including McDonalds, Starbucks, Target, and even Dollar Tree are countering with aggressive discounting.

Source: The Wall Street Journal

Yet, in aggregate, Americans are continuing to increase their spending (as reflected in the second quarter growth numbers). In past Commentaries we have pointed out the importance of the “wealth effect” on current spending. Those benefitting from the very large increase in household net worth since 2020 are spending more and saving less. This includes retirees, a rapidly rising segment of our population.

In general, the 65% of homeowners with either no mortgage or a low interest mortgage are in a better position to increase their spending. Many outside of this group have faced burdensome rent increases and vastly higher costs associated with owning a home.

This has led to a widening generational wealth gap. Gen Xers, Baby Boomers, and Silent generations have much higher rates of home ownership than Millennials and Gen Z.

Another divide is developing within the younger generations – those with parental help versus those without. Many wealthier families assist their children with the purchase of a home. This is just one part of the $50 trillion wealth transfer that will take place in the coming two decades from Boomers and Silents. This adds a significant source of economic support over the coming years that is not in most economic models.

However, this extends the “wealth disparity” from one generation to the next. Children of the less fortunate will depend more than ever on the availability of a quality education and well-paying jobs to achieve their American dream.

This is one reason that economists focus much of their research on employment and wage dispersion. The healthy jobs market and strong wage growth within the lower income groups have been a welcome component of the current recovery.

Focus turns to Jobs. The Fed has two mandates – keep inflation under control and maintain a healthy jobs market. Since early 2022, The Fed has been able to focus its policies almost exclusively on inflation which had surged out of control. Jobs, on the other hand, were abundant and unemployment at lows not seen since the 1960s.

Source: The Wall Street Journal

Yet it appears that this script has changed. Inflation has all the appearances of now being under control – if not yet at the Fed’s 2% target. The latest Consumer Price Index (CPI) reading showed a monthly decline in prices for the first time since May 2020. See Chart 3.

On the other hand, the jobs market has weakened considerably in the past few months as attested by this past Friday’s Jobs Report. It indicated a net increase of only 114,000 new jobs in July and a reduction of 27,000 in June’s report. Unemployment came in at 4.3%, now up 0.9% from its low last year.

A look inside the Jobs Report indicates that the weakness may be overstated. First, the increase in the unemployment rate was completely from the addition of new entrants looking to enter the labor force, not from layoffs. Second, those temporarily unemployed due to weather came in at a huge 1.5 million – a number only exceeded five times in the past 84 months. Hurricane Beryl may have had a hand in this report.

However, other labor market indicators are also weakening. Job openings per unemployed worker are down sharply, those on long-term unemployment continue to grow, weekly new unemployment claims have jumped, and full-time jobs have barely moved over the past year.

While the labor market deterioration is never welcomed, some softening within the jobs market was inevitable as it “normalizes” toward pre-pandemic levels.

It is not just the jobs market that is weakening. The ISM Manufacturing report that came out this past Thursday was much weaker than expected. In addition, important stalwarts of this recovery such as restaurants and airlines have recently reported slower sales than expected.

While the case for an impending recession (hard landing) has increased, a “soft landing” (general slowdown without a recession) remains most economists’ base case. As one economist noted, “It is hard to see a recession when combining healthy income growth with significantly higher net worths.”

If a recession were to develop, the Fed will bring down today’s high interest rates rapidly. This would benefit all the interest sensitive parts of our economy including small businesses and commercial real estate. Lower mortgage rates would breathe new life into the now moribund housing market.

Globally, economic conditions have not been as strong. Developed nations in Europe are struggling to deliver growth of even 1%. China, the second largest economy and the primary driver of global economic growth since 2000, is experiencing a significant slowdown which has major spillover effects on other countries.