Wealth Planning Insights

Explore: Wealth Planning Founder’s Perspectives Books

Navigating Medicare Premium Surcharges

Keith Fenstad, CFP®, January 2024

Tanglewood performed more income tax reviews and projections for our Wealth Management clients in 2023 than any other year.

Areas that proved most beneficial include Roth conversion opportunities and uncovering more efficient charitable gifting strategies. In a surprising number of cases, we discovered errors and omissions in client tax returns that either saved money or reduced the likelihood of an audit. We are further expanding this and other planning “pillars” in 2024.

Many of these tax planning discussions revolved around analysis of converting traditional IRA funds into a Roth IRA. The conversion is considered taxable income, so the decision on the appropriate amount is unique for each client. Variables such as current year income, income tax rate, expected future tax rate, client ages, size of the IRA, client health, beneficiaries etc. impact the decision making process.

For clients on Medicare, there was one element of the analysis that almost always seemed to strike a particularly sensitive nerve – the “Income-Related Monthly Adjusted Amount” (IRMAA).

Perhaps IRMAA is so disliked because it is visible each month (as a reduction of social security retirement benefits). A higher IRMAA bracket means paying more for the same benefits.

What is IRMAA Exactly? IRMAA represents an increase to the monthly Part B and Part D premium over the base amount as determined by Medicare each year. Simply put, it is a surcharge that increases the premium for those with higher incomes. The higher the income, the greater the surcharge.

IRMAA increases are calculated every year based on Modified Adjusted Gross income (MAGI) as reported on your tax return from the two years prior. 2024 Medicare premiums are based on your 2022 return and the recently completed 2023 tax year will affect 2025 premiums.

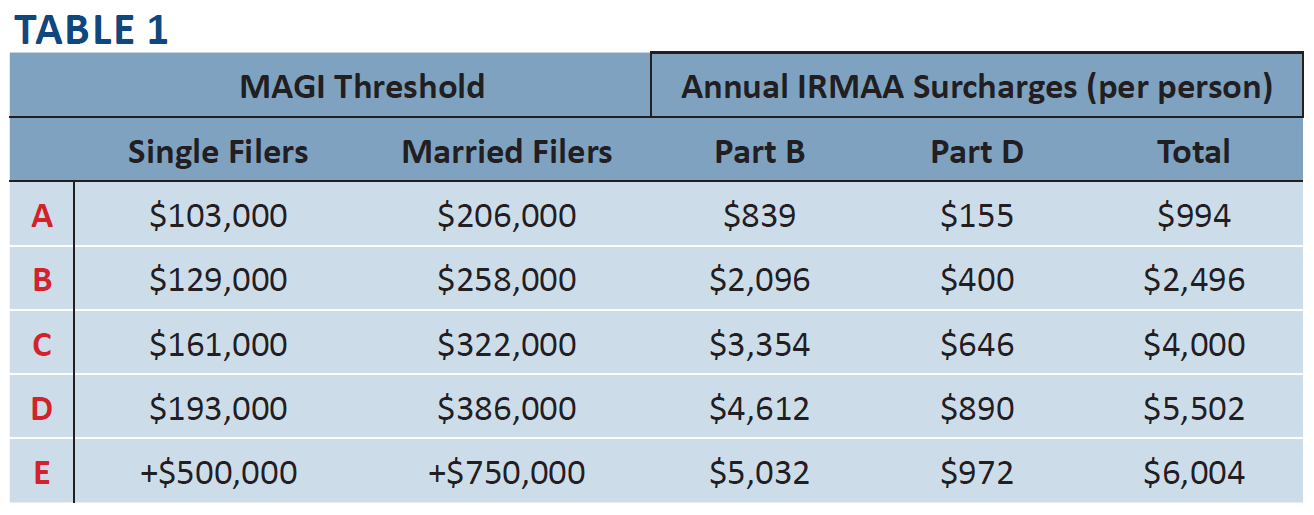

Specifically, MAGI is your reported Adjusted Gross Income plus any tax-free interest or dividends received that year. The IRMAA surcharge is determined by both the MAGI number and a taxpayer’s filing status. Here’s a summary of the thresholds for 2024. See Table 1.

Source: Holistiplan

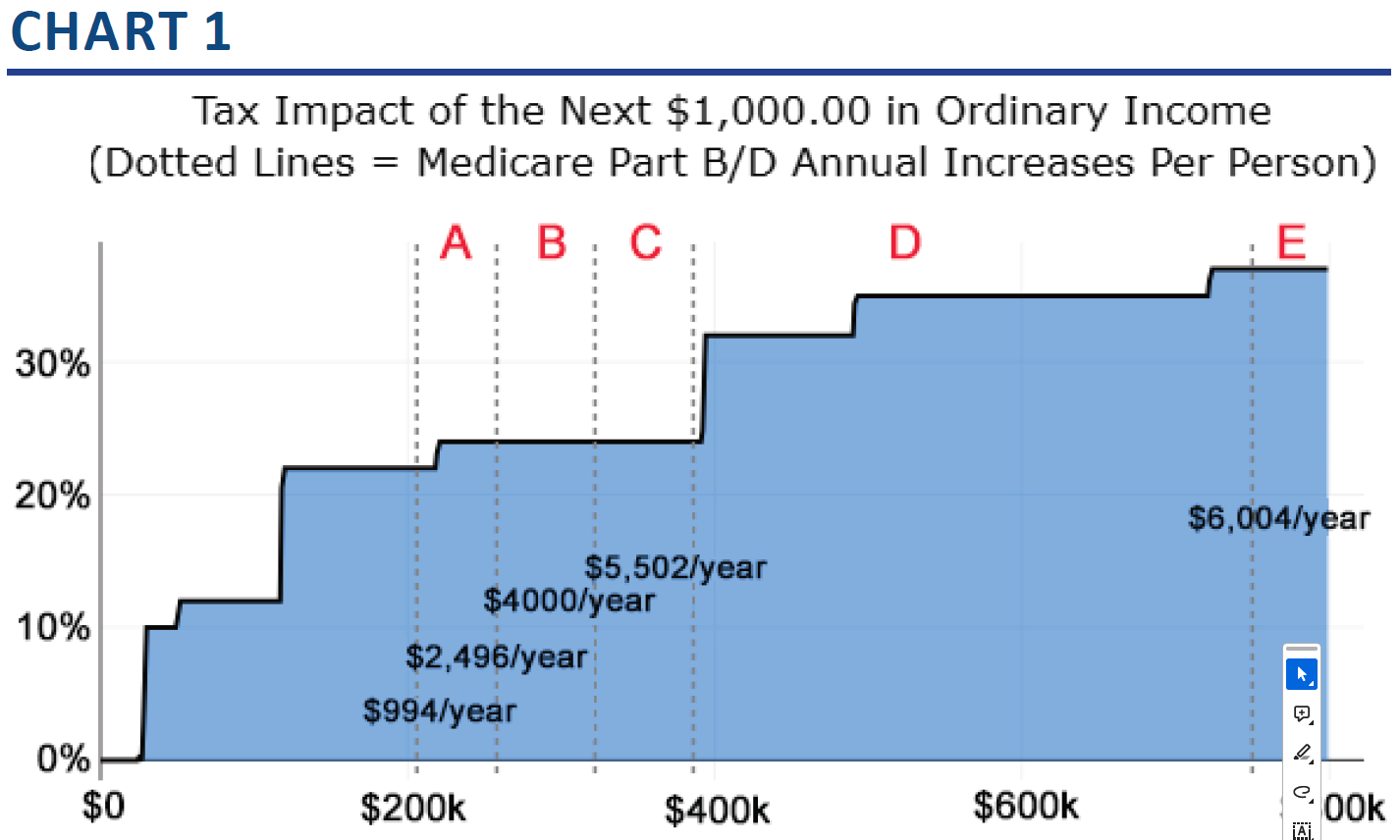

Chart 1 shows how IRMAA aligns with ordinary income tax rates for a joint filer. Taxable income is across the bottom and tax rate percentage is along the vertical axis. The dotted lines represent the IRMAA surcharge thresholds. Unfortunately just one dollar across the threshold incurs the full annual adjustment - no tiering or phase-in.

We help optimize a client's income within the 22% and 24% ordinary tax rate, while also navigating three levels of IRMAA surcharges. This planning is most critical for those clients with large IRA accounts facing significant required minimum distributions in the future.

It is Just Another Tax. Depending on the starting point, the surcharge viewed as a percentage might not be as onerous as it seems on the surface.

For example, a couple starting from the first threshold "A" considering a Roth conversion to fill the 24% bracket is looking at an incremental surcharge of $3,006 per person (A to C). As a percentage of the incremental income of $180,000, it’s a 3.3% equivalent tax.

If that couple started from the second IRMAA threshold "B", the incremental cost would be $1,504 per person (B to C) and a conversion of up to $128,000 would be possible to get to the same point – a 2.3% equivalent tax.

These are not inconsequential dollar amounts but should be looked at in the broader context of lifetime tax planning. Meaningful Roth conversions forever reduce RMDs and taxable distributions. IRMAA surcharges should not be the only factor in determining how much to convert or whether a Roth conversion makes sense.

As you file your 2023 tax return, this is an early reminder to send Tanglewood a copy for review and use as the basis for 2024 tax planning. Your Wealth Advisor and team stand ready to help.